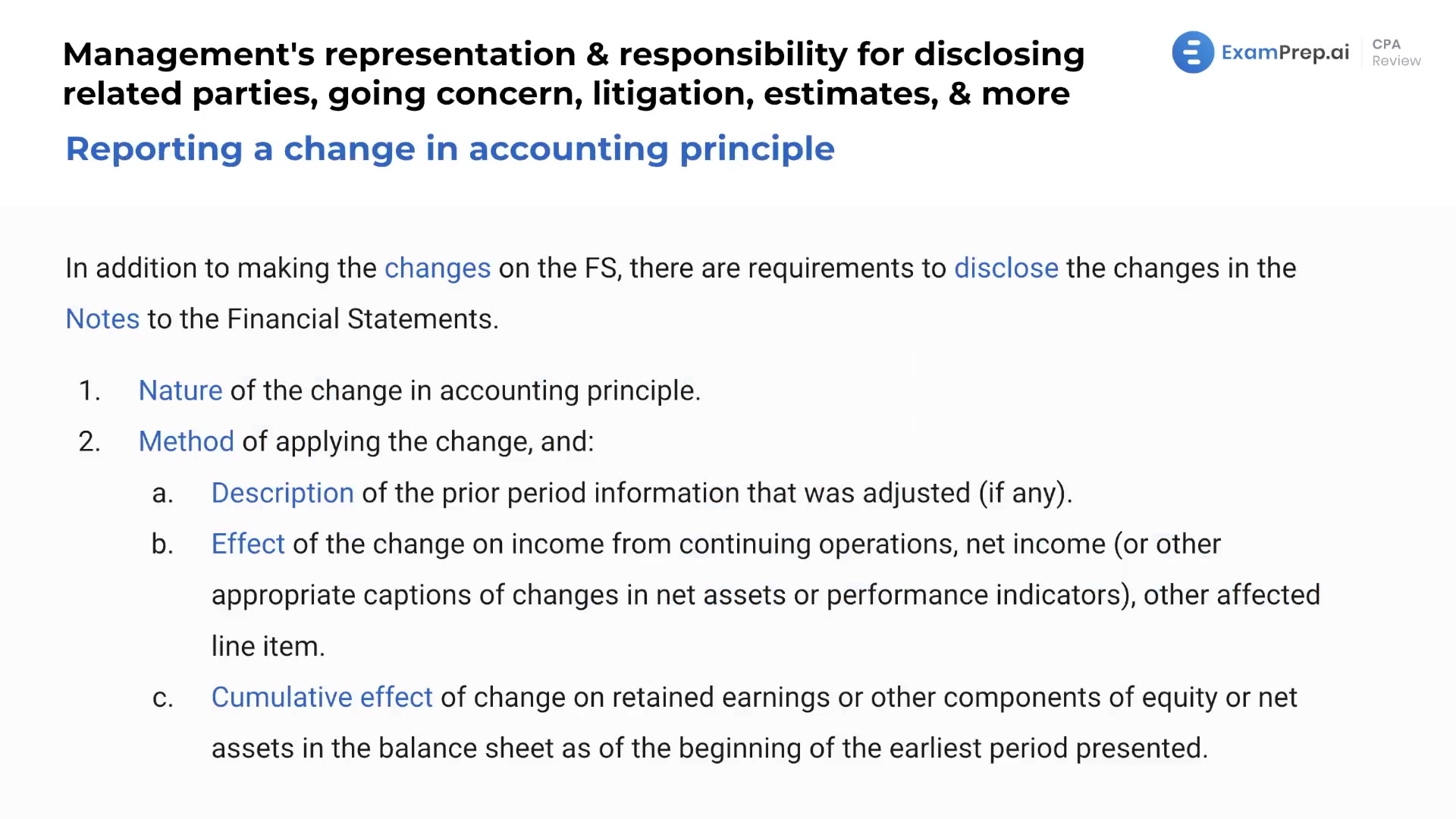

In this lesson, the different types of accounting changes are discussed, including changes in accounting principles, accounting estimates, and reporting entities. The lesson emphasizes the crucial role auditors play in ensuring that these changes are properly reported and implemented. Examples of accounting principle changes include adopting a new FASB standard or changing inventory methods. Changes in accounting estimates can involve revisions to depreciation methods, useful life, residual values, or pension plan actuarial estimates, among others. Lastly, examples of changes in reporting entities may include consolidations, acquisitions, or the creation of new subsidiaries. The lesson also briefly touches on accounting errors and highlights their distinction from accounting changes.

This video and the rest on this topic are available with any paid plan.

See Pricing