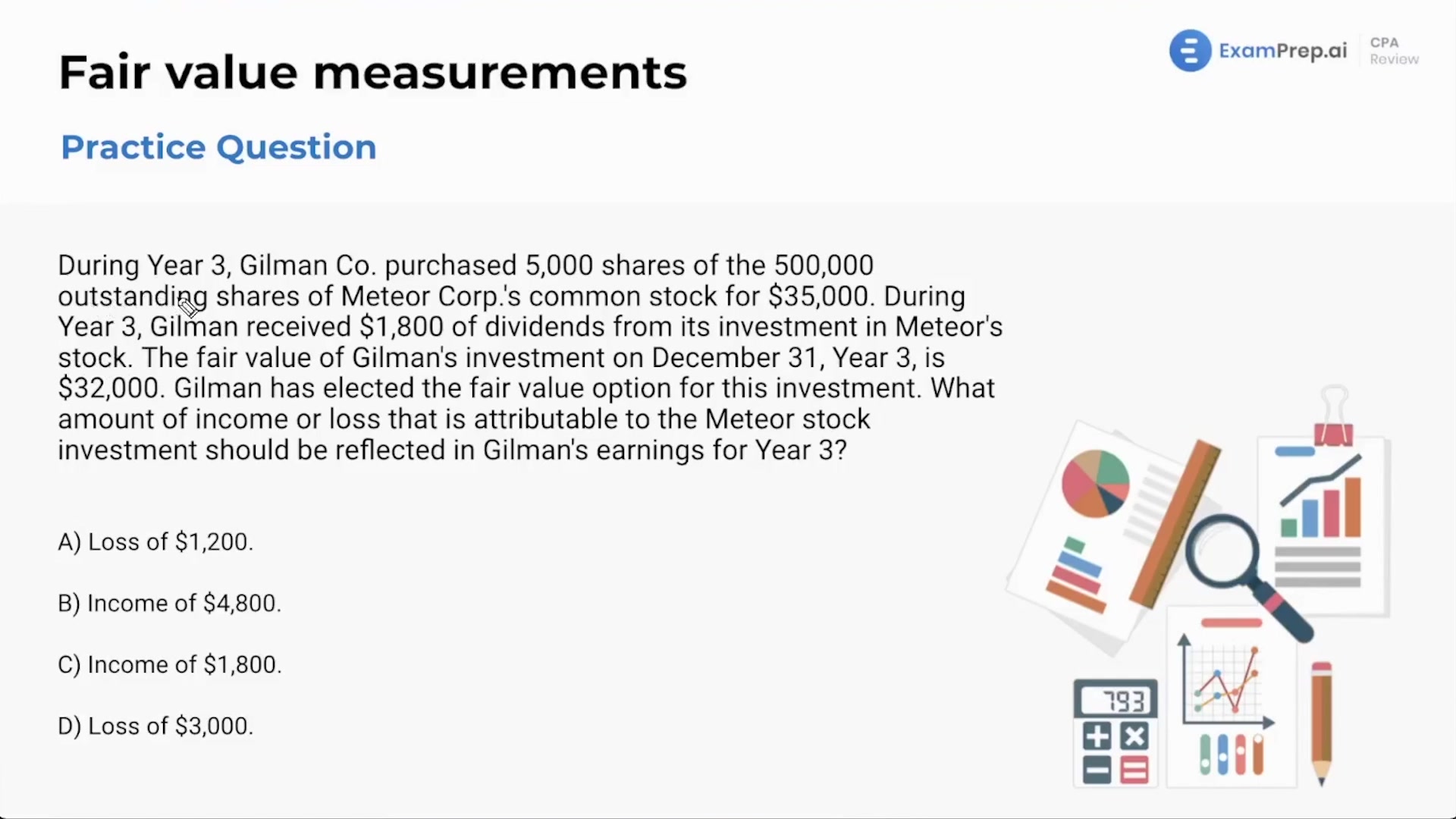

In this lesson, Nick Palazzolo, CPA, dives into the topic of fair value measurements by tackling a few practice questions. With his usual clarity, he breaks down the fair value hierarchy into its levels, providing relatable examples for each category. He offers a tangible approach to distinguishing Level 2 inputs from Levels 1 and 3 by explaining how to use quoted prices for similar assets. In addition to demystifying these concepts, Nick walks through a practical example to compute the gain or loss using the fair value option for investments, including how to factor in dividends received. His engaging walkthrough of these scenarios reinforces the understanding of fair value accounting, ensuring that by the end of the lesson, the process of adjusting for dividends and recognizing gains or losses will be clearer.

This video and the rest on this topic are available with any paid plan.

See Pricing