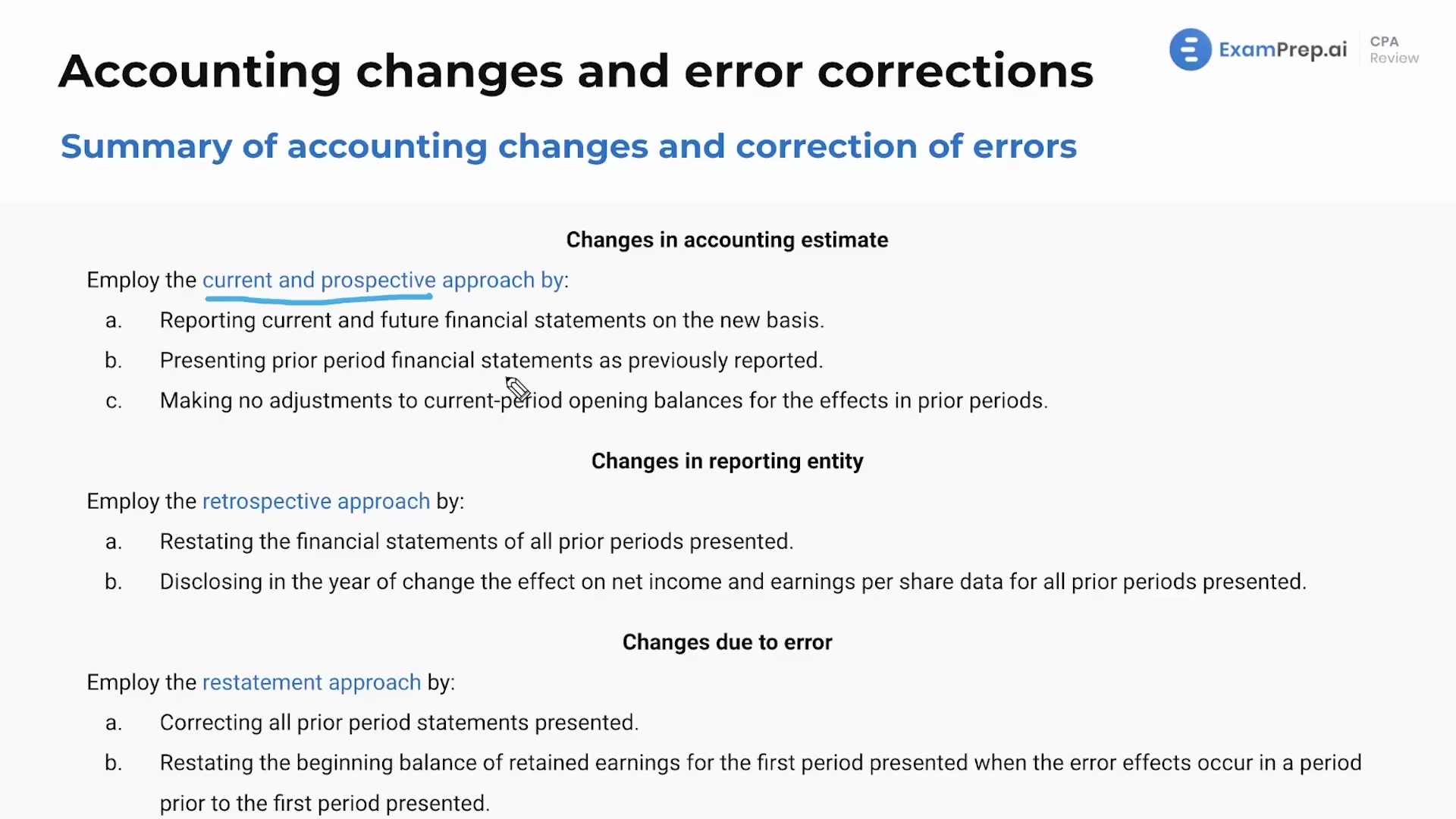

In this lesson, explore the intricacies of accounting changes and error corrections with the expert guidance of Nick Palazzolo, CPA. He breaks down the retrospective approach for corrections involving changes in accounting principles, such as how and when to restate financial statements for past periods when transitioning to a method like FIFO, and how this impacts net income and earnings per share. Nick clarifies when it is impracticable to apply changes retrospectively and what alternative measures to take in these cases. Additionally, he tackles changes in accounting estimates, stressing that past financial statements should remain unchanged while highlighting the method of recording adjustments in current and future reporting. Nick also explains how changes due to errors necessitate a restatement of prior periods to correct mistakes, ensuring retained earnings reflect accurate information. Throughout the lesson, he emphasizes on the importance of transparency in financial reporting and concludes with a motivational note, encouraging persistent learning and practice to achieve mastery in these complex topics.

This video and the rest on this topic are available with any paid plan.

See Pricing