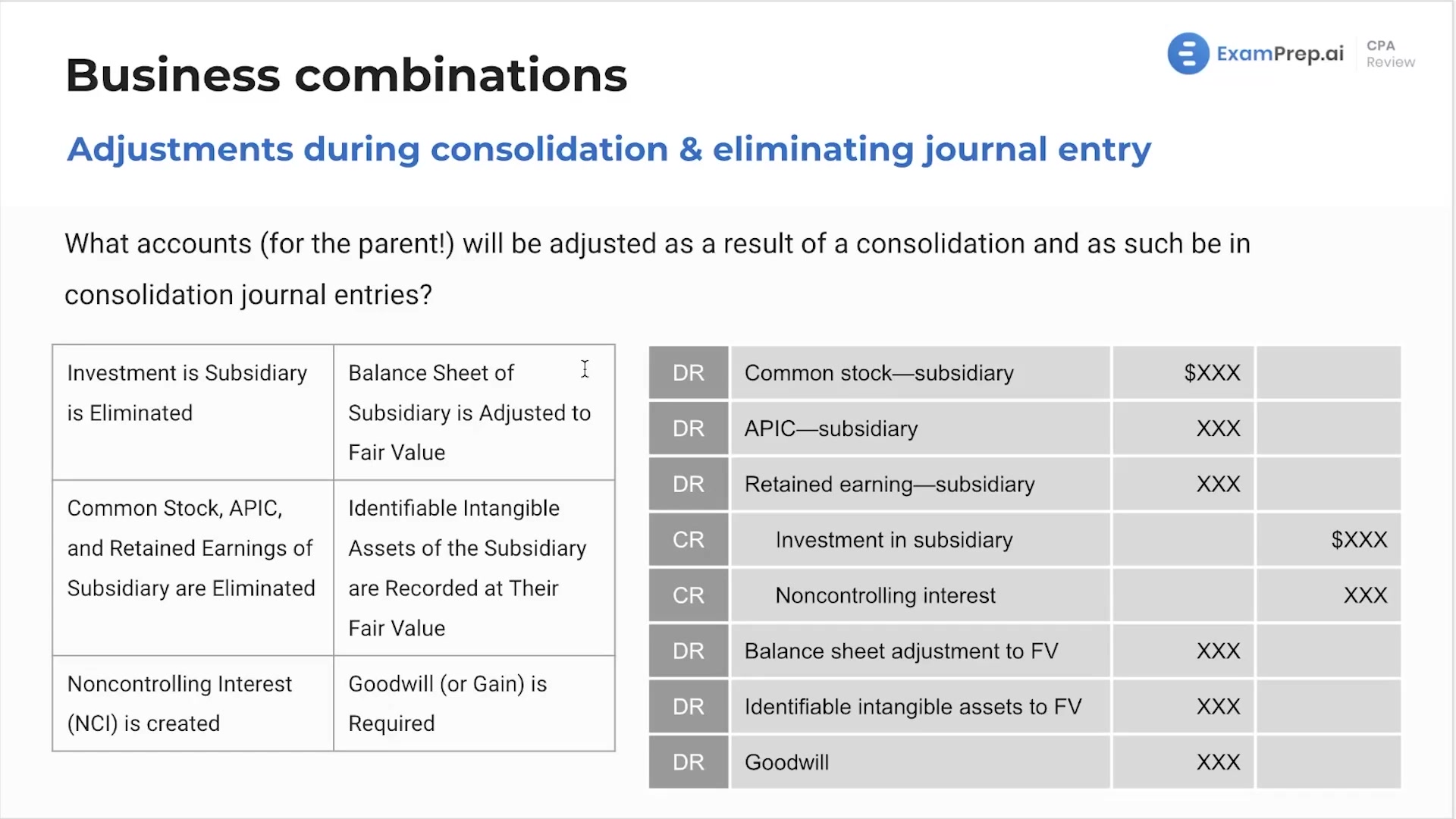

In this lesson, Nick Palazzolo, CPA, breaks down the financial ins and outs of accounting for a company acquisition. From the initial purchase transaction—using cash, stock, or debt securities—to the subsequent adjustments and consolidations required, Nick covers the critical accounting moves necessary for recording an investment in a subsidiary. The instruction includes how to handle equity accounts during consolidation and the role of goodwill and bargain purchases in financial reporting. With clear examples, Nick clarifies the concept of additional paid-in capital (APIC) and why revaluation of a company during acquisition is a strategic move. The processes of eliminating investment in subsidiaries, creating non-controlling interest (NCI), and recognizing identifiable intangible assets are also adeptly explained, providing a solid base for understanding this complex area of accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing