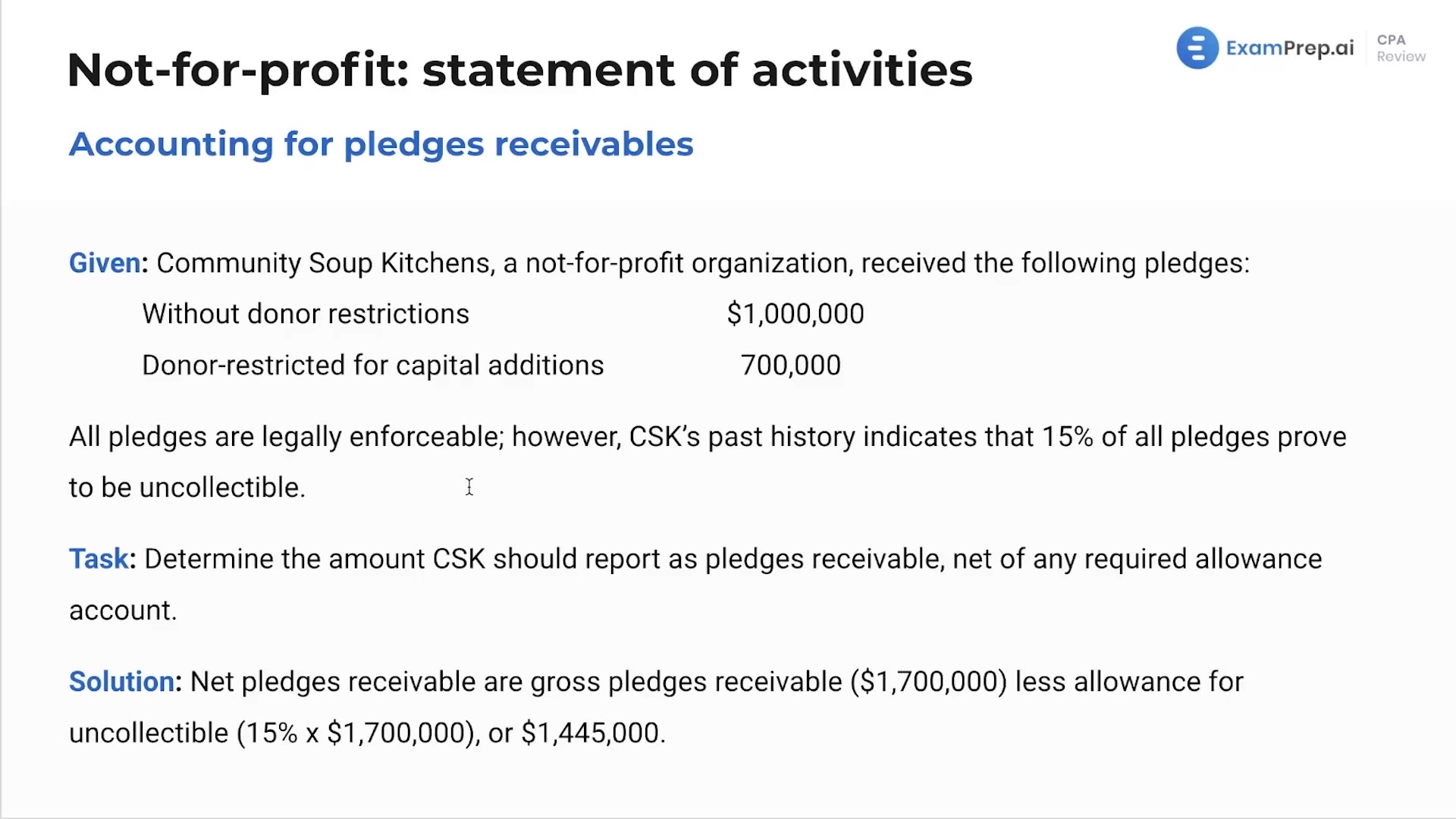

In this lesson, Nick Palazzolo, CPA, dives into the specifics of accounting for pledges receivable within a not-for-profit context, using a realistic scenario involving a community soup kitchen. He breaks down the process of recording pledges that are promised to the organization, demonstrating the calculations necessary to account for potential uncollectible amounts. Nick emphasizes the importance of understanding the difference between restricted and unrestricted funds, and he shows how to report the net pledges receivable with a clear, step-by-step approach to handle the allowances for uncollectible pledges. Watch as Nick simplifies these concepts, making them approachable and easier to navigate.

This video and the rest on this topic are available with any paid plan.

See Pricing