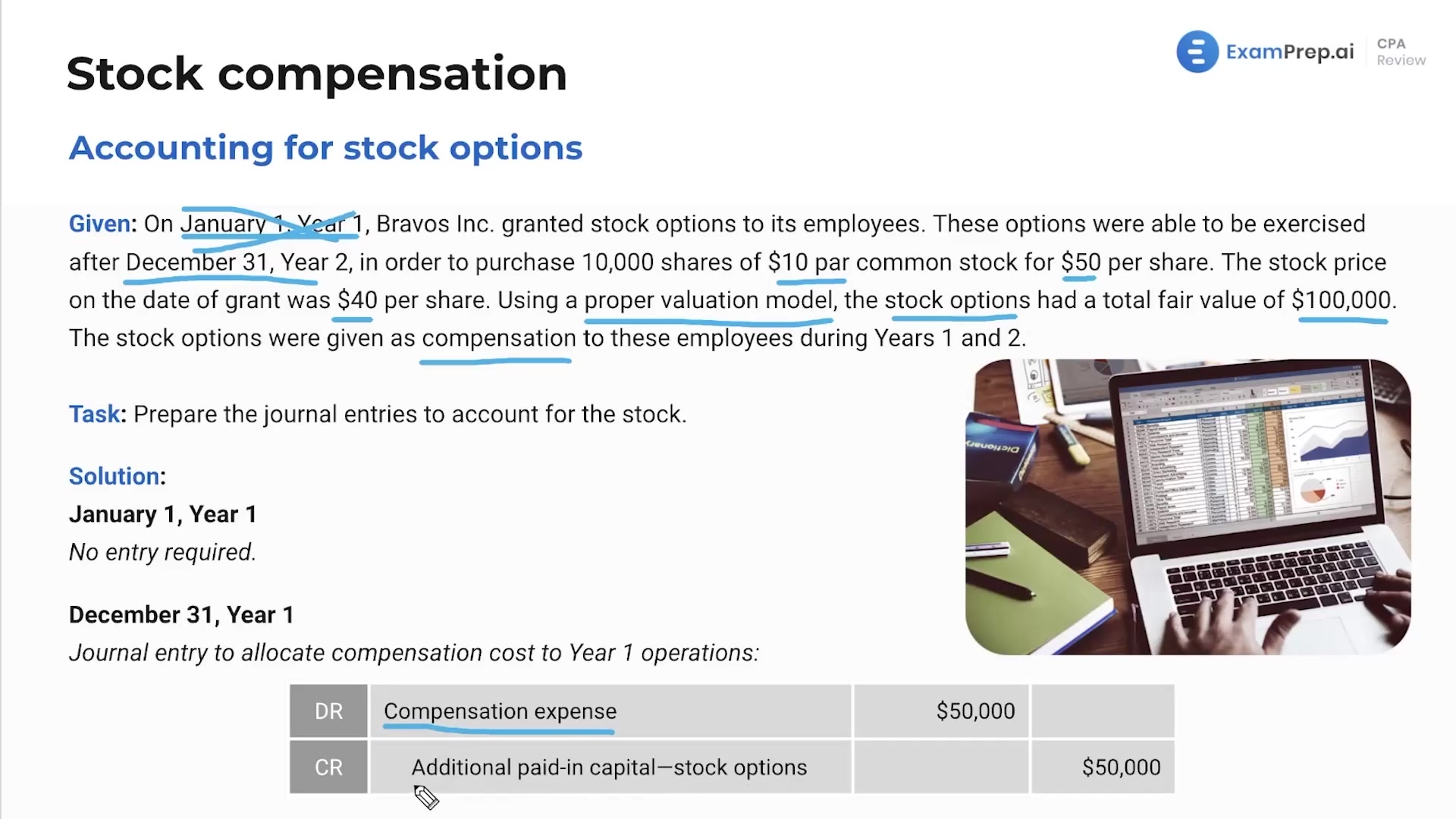

In this lesson, dive into the intricacies of accounting for stock options with Nick Palazzolo, CPA, as he meticulously breaks down the journal entries associated with compensatory stock options. The session starts off with a practical example that illustrates the timeline from grant date to exercise, explaining vesting periods and exercise prices. Nick clarifies the distinction between par value and market value, while emphasizing the importance of a fair valuation model, such as Black Scholes, for determining stock option value. Follow along as he walks through the accounting treatment similar to salaries and wages, spreading the recognition of expense over the service period, and concludes with the financial implications upon the exercise of stock options, detailing the corresponding impact on additional paid-in capital (APIC) and common stock issuance.

This video and the rest on this topic are available with any paid plan.

See Pricing