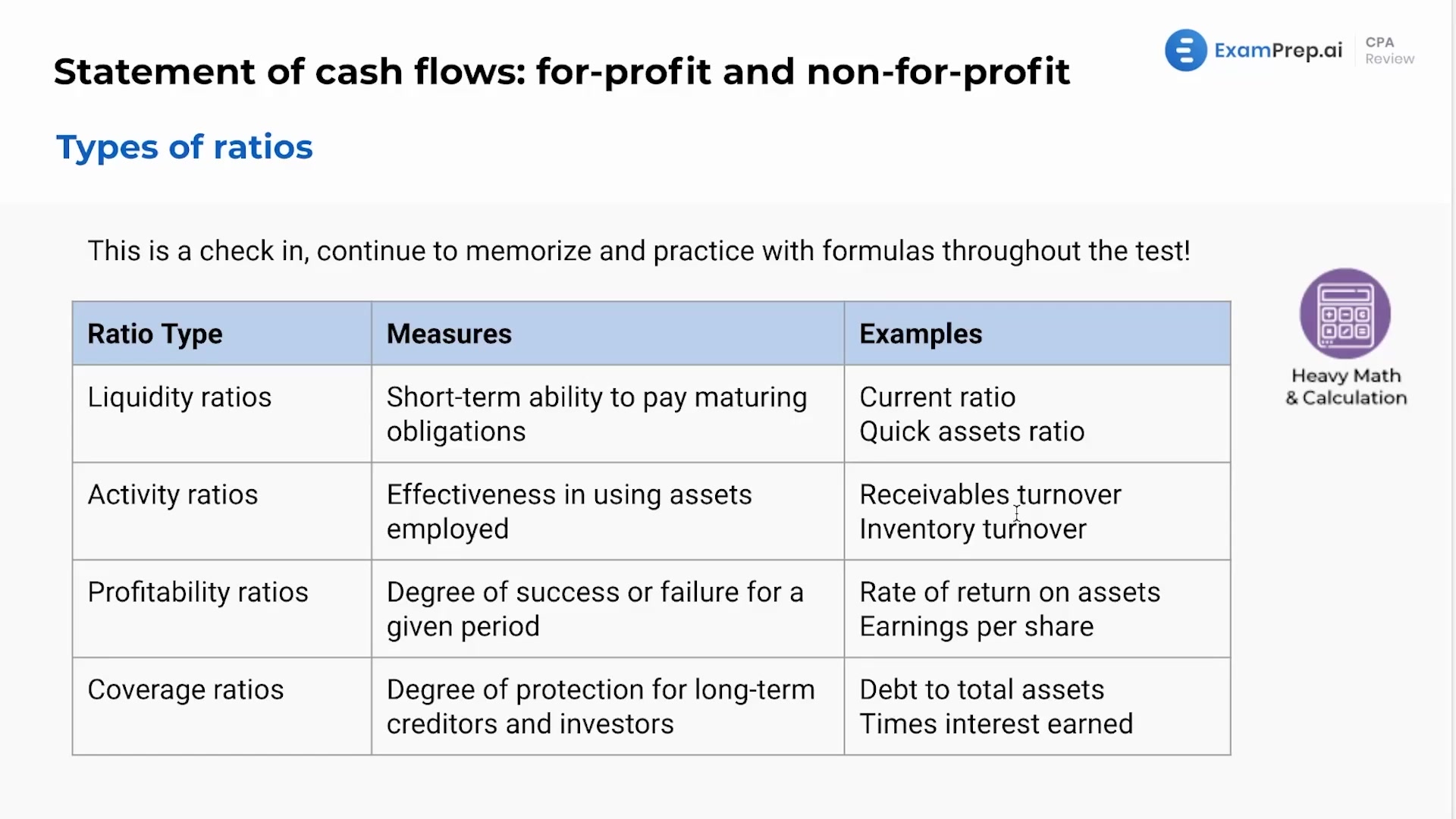

In this lesson, Nick Palazzolo, CPA, dives into the essential financial accounting ratios, elaborating on their relevance to various stakeholders such as investors and creditors. He breaks down liquidity, activity, profitability, and coverage ratios, explaining how each measures a company's financial health and operational efficiency. Through examples like current and quick ratios, receivables and inventory turnover, earnings per share, and the debt to total assets ratio, Nick clarifies how these ratios serve as indicators of a company's ability to meet its short-term obligations, utilize assets effectively, generate profits, and manage its debt. This insightful walkthrough reinforces the importance of understanding and memorizing these ratios, not just for the exam but for their broader application in the financial world.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free