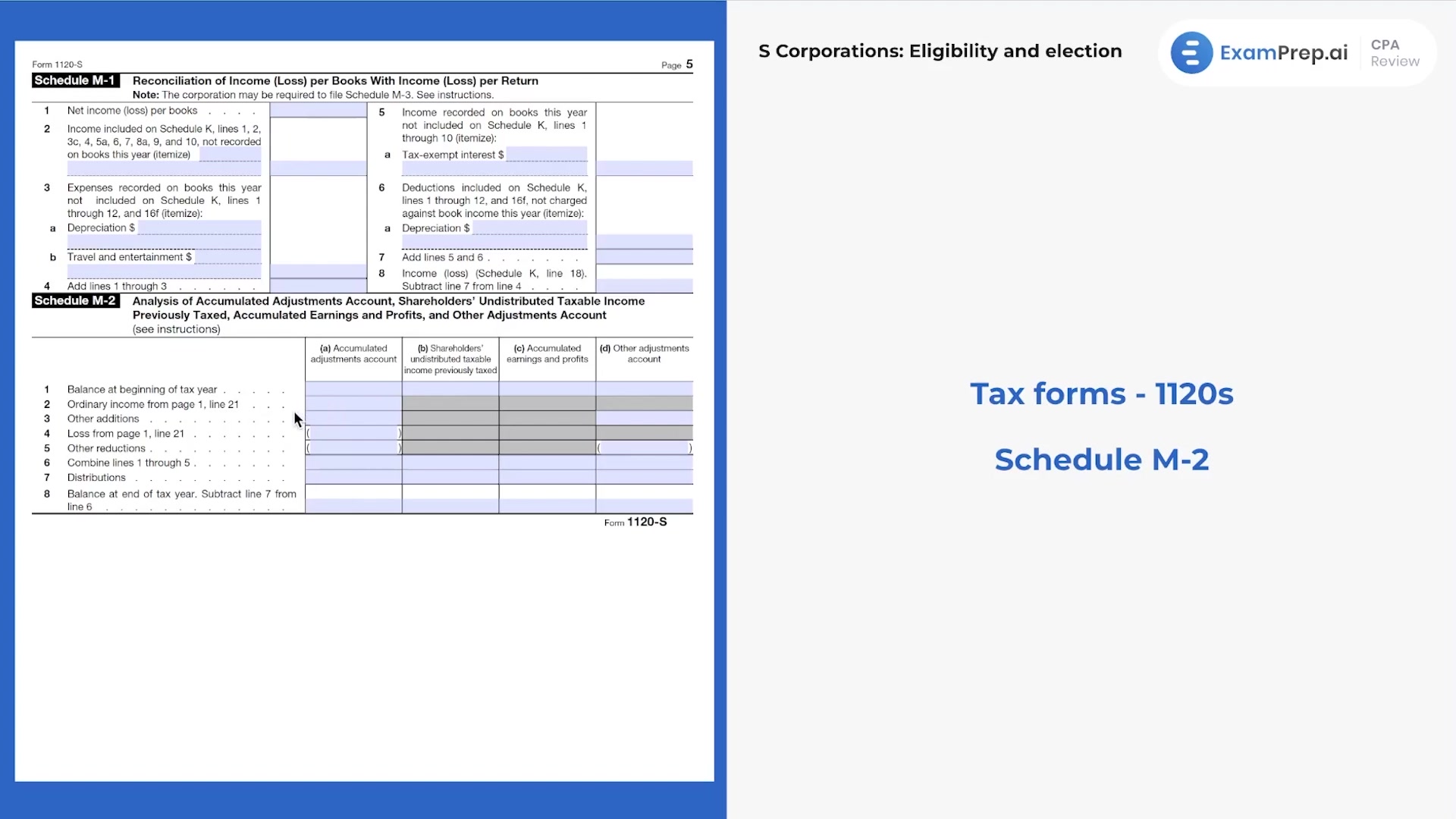

In this lesson, Nick Palazzolo, CPA, simplifies the intricacies of the Accumulated Adjustments Account (AAA) and the Other Adjustments Account (OAA) for an S-corporation. He contrasts these accounts with the retained earnings from C-corporations, clarifying their roles in tracking accumulated earnings and how they affect the tax treatment of shareholder distributions. With a clear, straightforward approach, Nick delves into how the AAA is affected by taxable income, distributions, and nondeductible expenses, elucidating its impact on the tax-free return of capital and ordinary income classification. He also explains the OAA's role in recording adjustments for tax purposes, including accounting method changes and gains or losses. By the end of this session, the tax implications of distributions and the importance of these accounts in shareholders' basis in stock are demystified with helpful comparisons and practical examples.

This video and the rest on this topic are available with any paid plan.

See Pricing