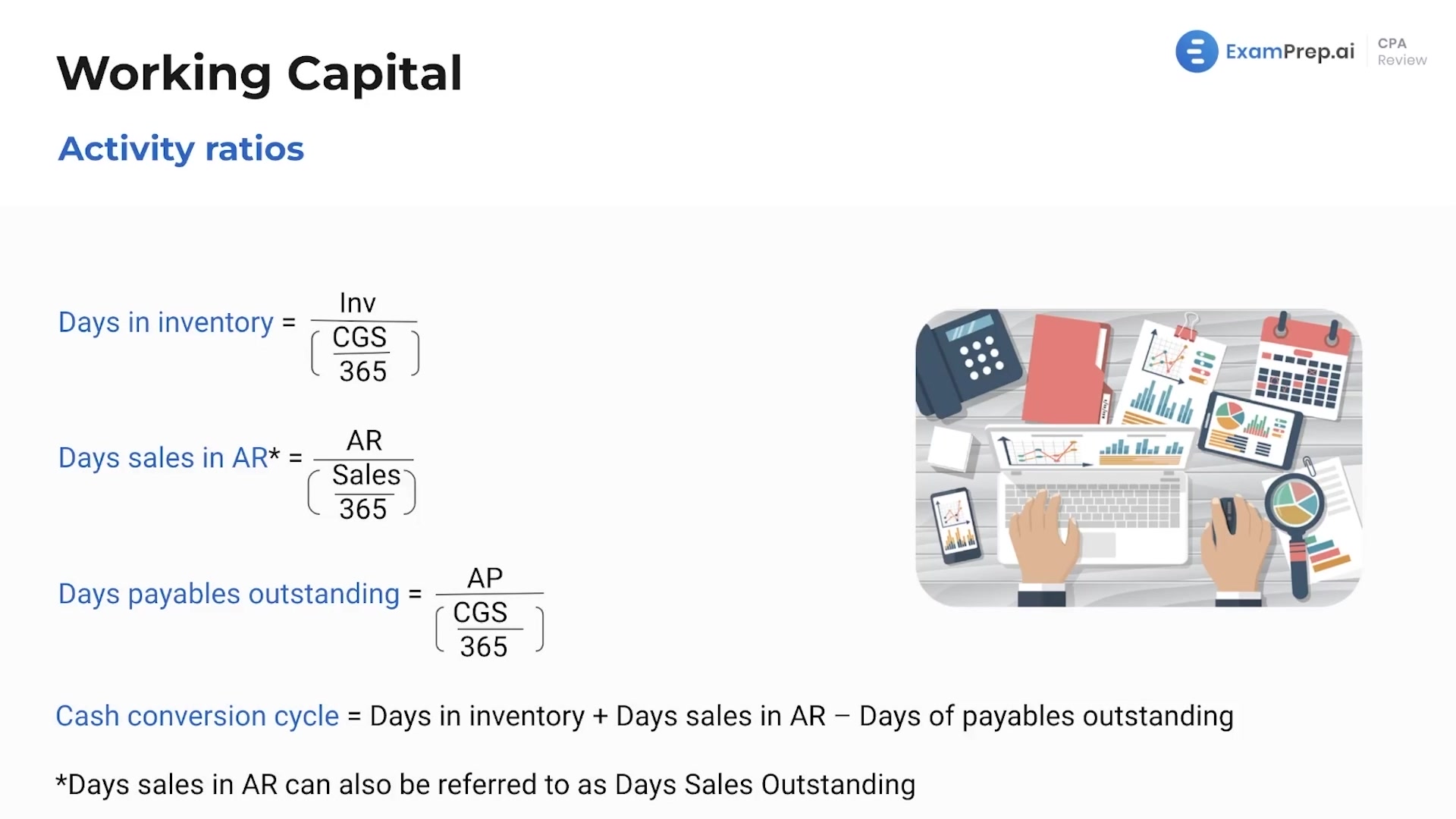

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of activity ratios by breaking down each component of the cash conversion cycle. He starts by examining how quickly a business can convert operations to cash, explaining the significance of days in inventory, days sales in accounts receivable, and days of payables outstanding. Nick offers insight into why certain ratios should be higher or lower and provides the formulas for calculating these metrics. Through a practical example with Silverstone Inc.'s financial data, he guides through the process of calculating the company's cash conversion cycle, emphasizing the real-world implications and practical uses of understanding these ratios to manage a business’s finances effectively.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free