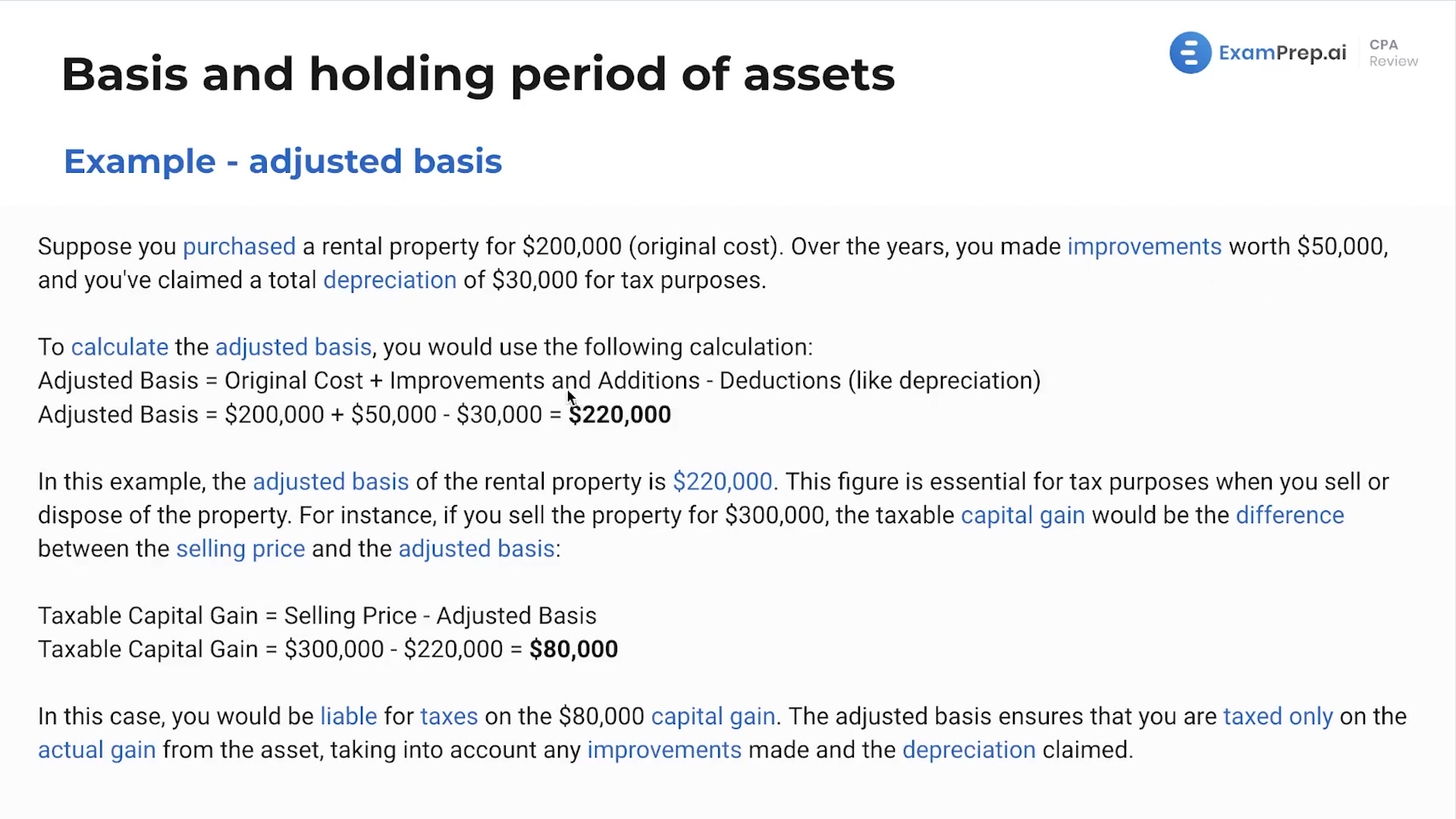

In this lesson, Nick Palazzolo, CPA, breaks down the concept of adjusted basis, a cornerstone in tax accounting crucial for calculating taxable gain or loss on an asset. He delves into how the original basis of an asset is altered over time by improvements, additions, and deductions such as depreciation. With practical examples, like adjustments on a rental property, Nick clarifies how these changes affect the asset's adjusted basis and, consequently, the taxable capital gain upon disposal. Emphasizing the significance of understanding this concept, he also hints at its implications for future topics such as S-Corporations and partnerships, reinforcing the idea that a higher adjusted basis can lead to favorable tax outcomes.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free