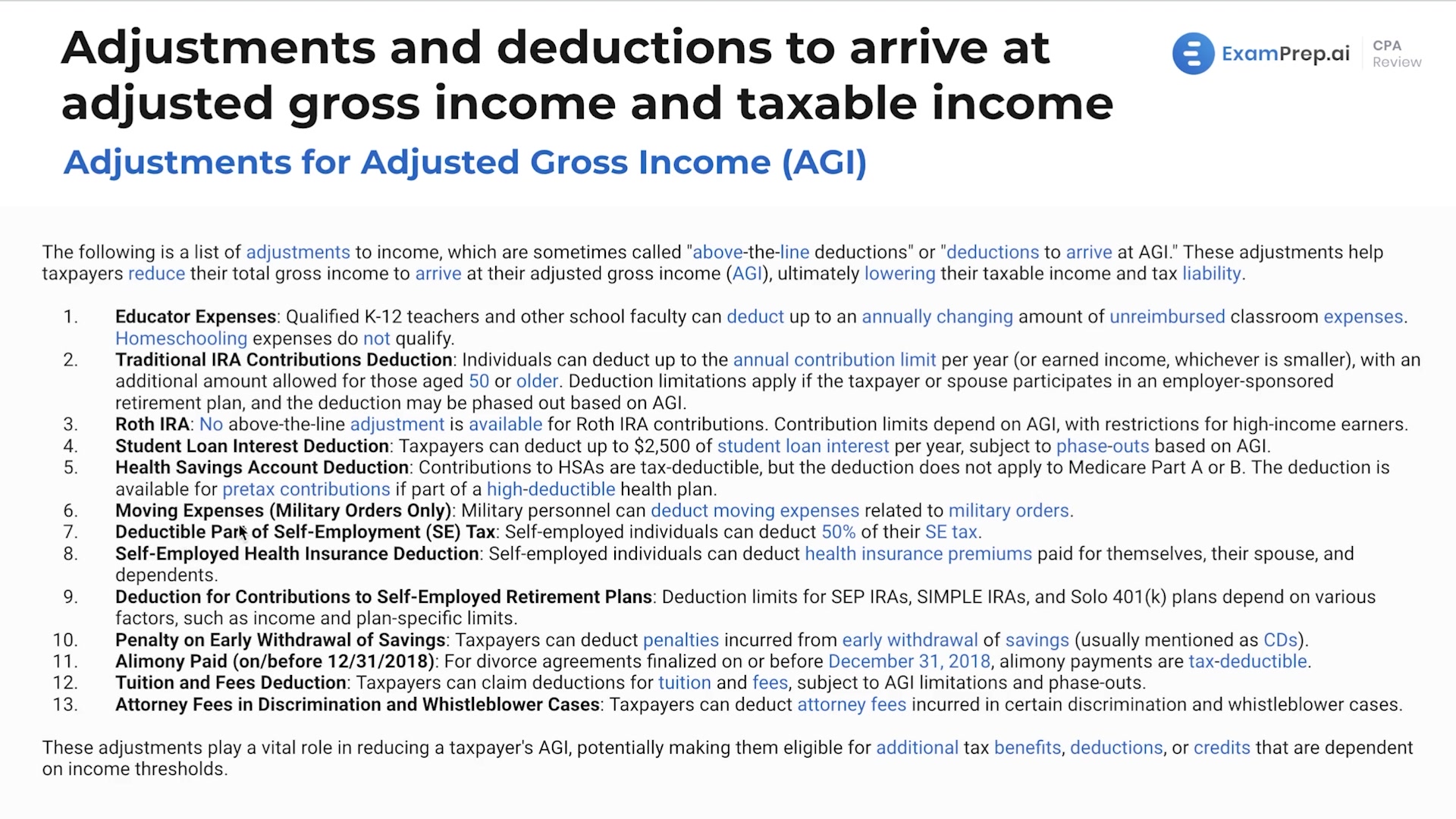

In this lesson, Nick Palazzolo, CPA, dives into the details of Adjusted Gross Income (AGI) adjustments, including a range of above-the-line deductions every tax preparer should be familiar with. With a comprehensive walkthrough, he explores educator expenses, traditional and Roth IRA contributions, the student loan interest deduction, HSA contributions, and the nuanced rules around alimony payments pre- and post the enactment of the Tax Cuts and Jobs Act. Nick also clarifies the unique conditions for moving expenses for military personnel and touches on the deductible portions of self-employment taxes and health insurance premiums for the self-employed. Learning these can be a challenge, but Nick emphasizes the importance of practice and memorization to master deductions on the 1040 form. Keep an eye out for penalties on early withdrawal of savings, and get an understanding of the phase-outs and limitations that affect tuition and fees deductions and attorney fees in legal settlements. This lesson is a solid foundation for a thorough grasp of income adjustments on individual tax returns.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free