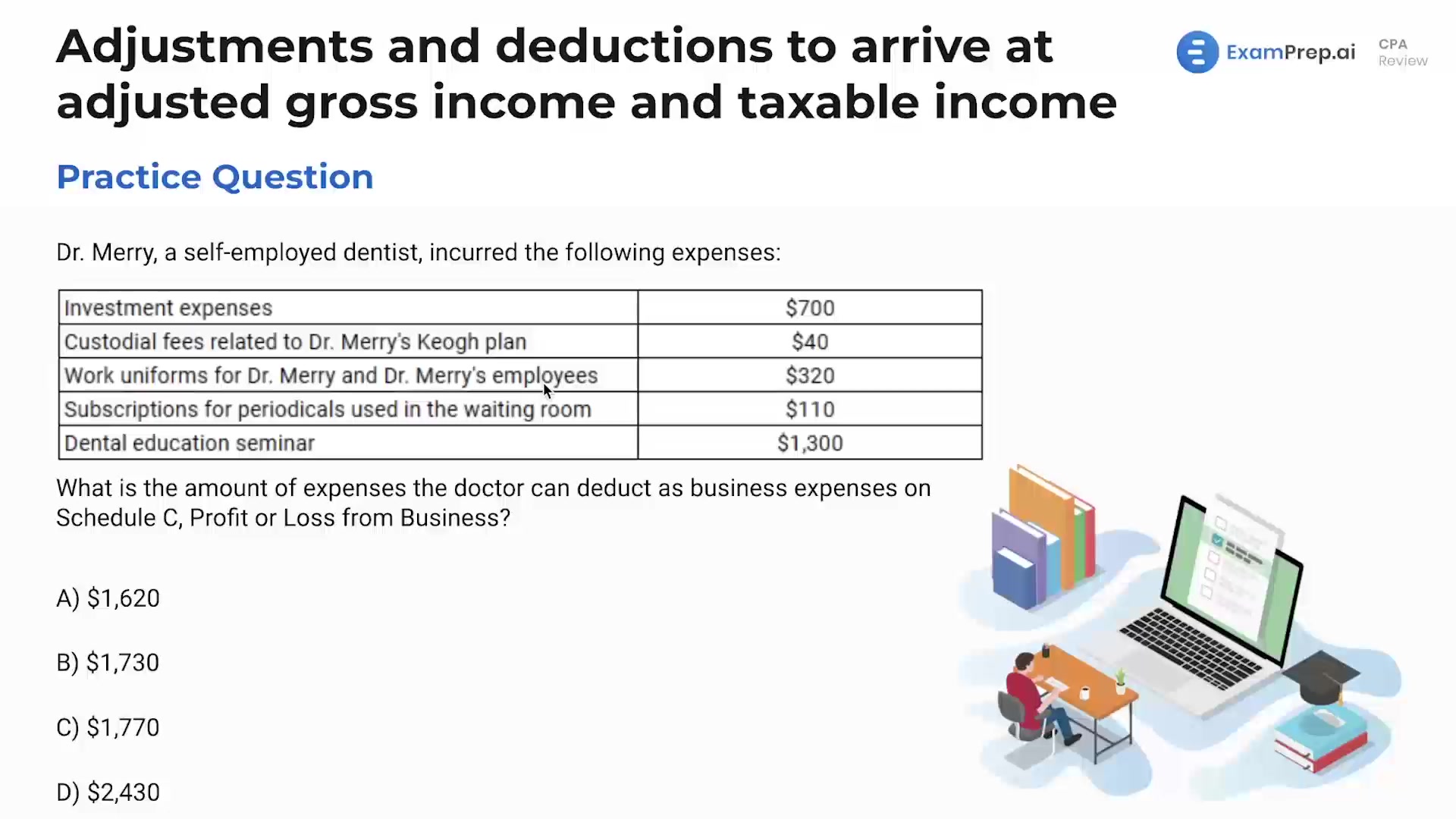

In this engaging lesson, Nick Palazzolo, CPA, delves into the intricacies of adjustments and deductions for determining adjusted gross income (AGI) using practical examples like Dr. Mary, a self-employed dentist. Nick demystifies which expenses are deductible for a business on Schedule C, such as work uniforms and seminar fees, while pointing out common pitfalls where candidates might misinterpret tax-deductible items. He also tackles the topic of non-business bad debts, illustrating the exact conditions under which candidates can deduct such losses from their taxable income. With a keen focus on the specific, real-life scenarios that bring clarity to complex tax concepts, Nick ensures a comprehensive understanding of what's essential for mastering these crucial topics.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free