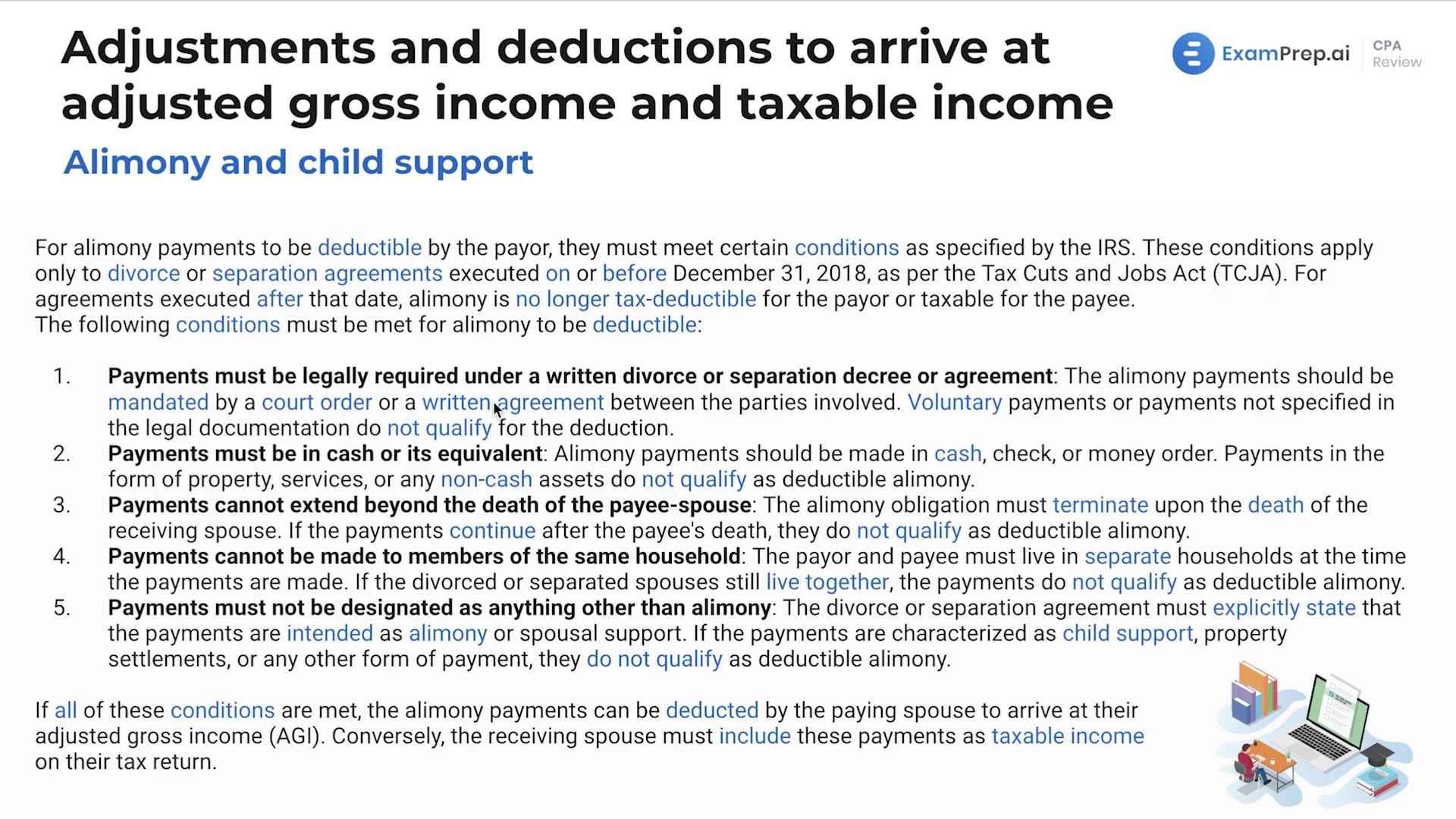

In this lesson, Nick Palazzolo, CPA, breaks down the nuances between alimony, child support, and student loan interest expenses. He delves into how these payments are treated for tax purposes, emphasizing the significant changes post-2018 divorce agreements. Nick clarifies that alimony, under certain conditions, used to be tax-deductible for the payer and taxable for the payee, unlike child support, which bears no tax implications for either party. He also discusses property settlements in divorce and their tax treatment. Lastly, Nick walks through calculating deductions for student loan interest expenses, making sense of the numbers with clear, practical examples to illustrate the points made. The information shared by Nick is valuable for grasping the intricacies of individual tax ramifications and applying this knowledge to real-world scenarios.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free