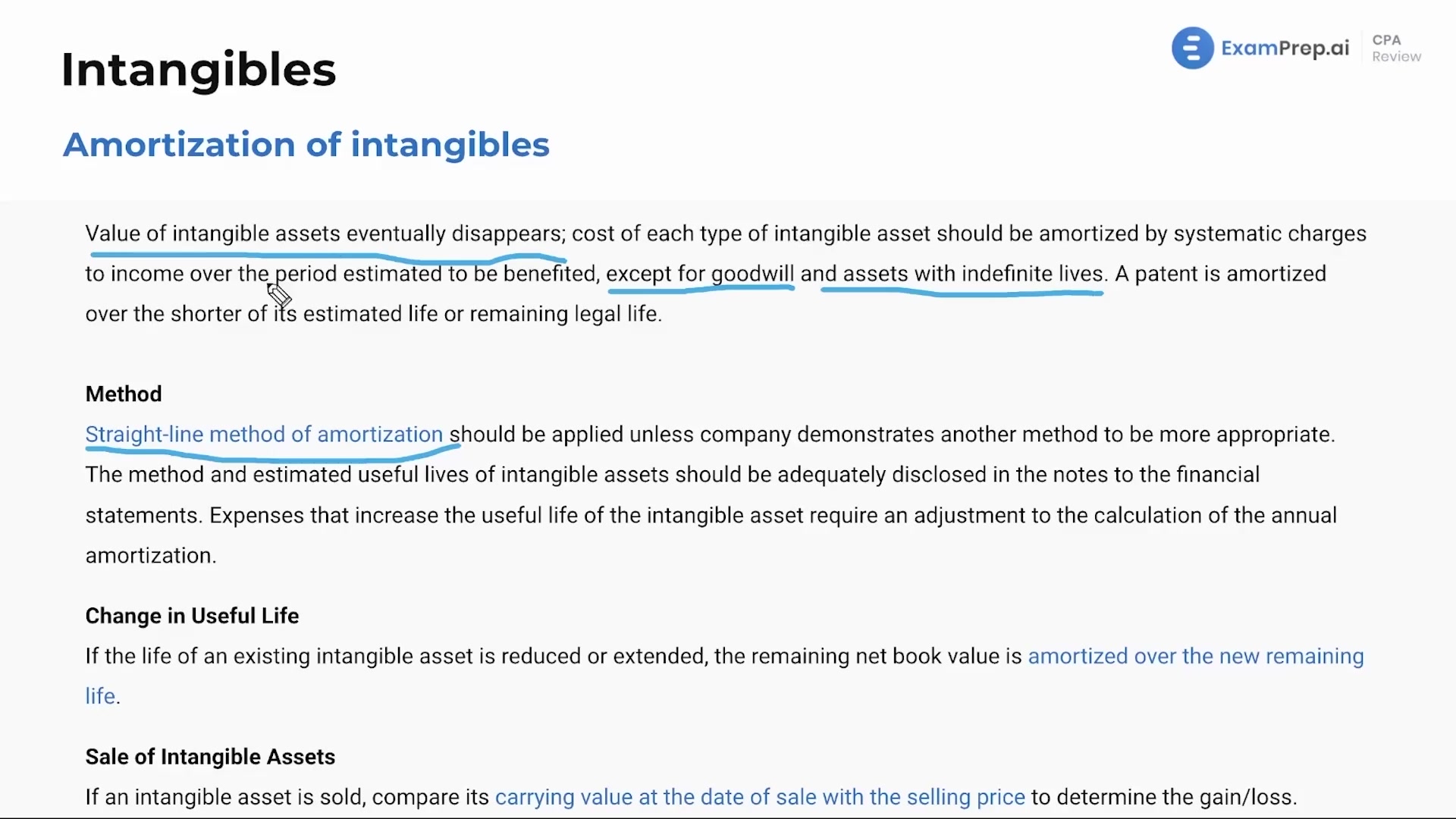

In this lesson, let's join Nick Palazzolo, CPA, as he simplifies the concept of amortizing intangible assets. He compares the process to depreciation, primarily using the straight-line method, and intricately outlines the exceptions for intangible assets like goodwill and those with indefinite lives. Nick also clarifies that while assets such as copyrights for intellectual properties may seem perpetual, like Disney's Mickey Mouse, they can be subject to impairment if their value diminishes. He provides practical examples to illustrate how intangible assets are amortized or impaired, and stresses the importance of transparently disclosing these valuations in the financial statement notes. Engage with Nick as he repeatedly emphasizes the similarities between depreciation and amortization to give a strong grasp of each concept's application on intangible assets.

This video and the rest on this topic are available with any paid plan.

See Pricing