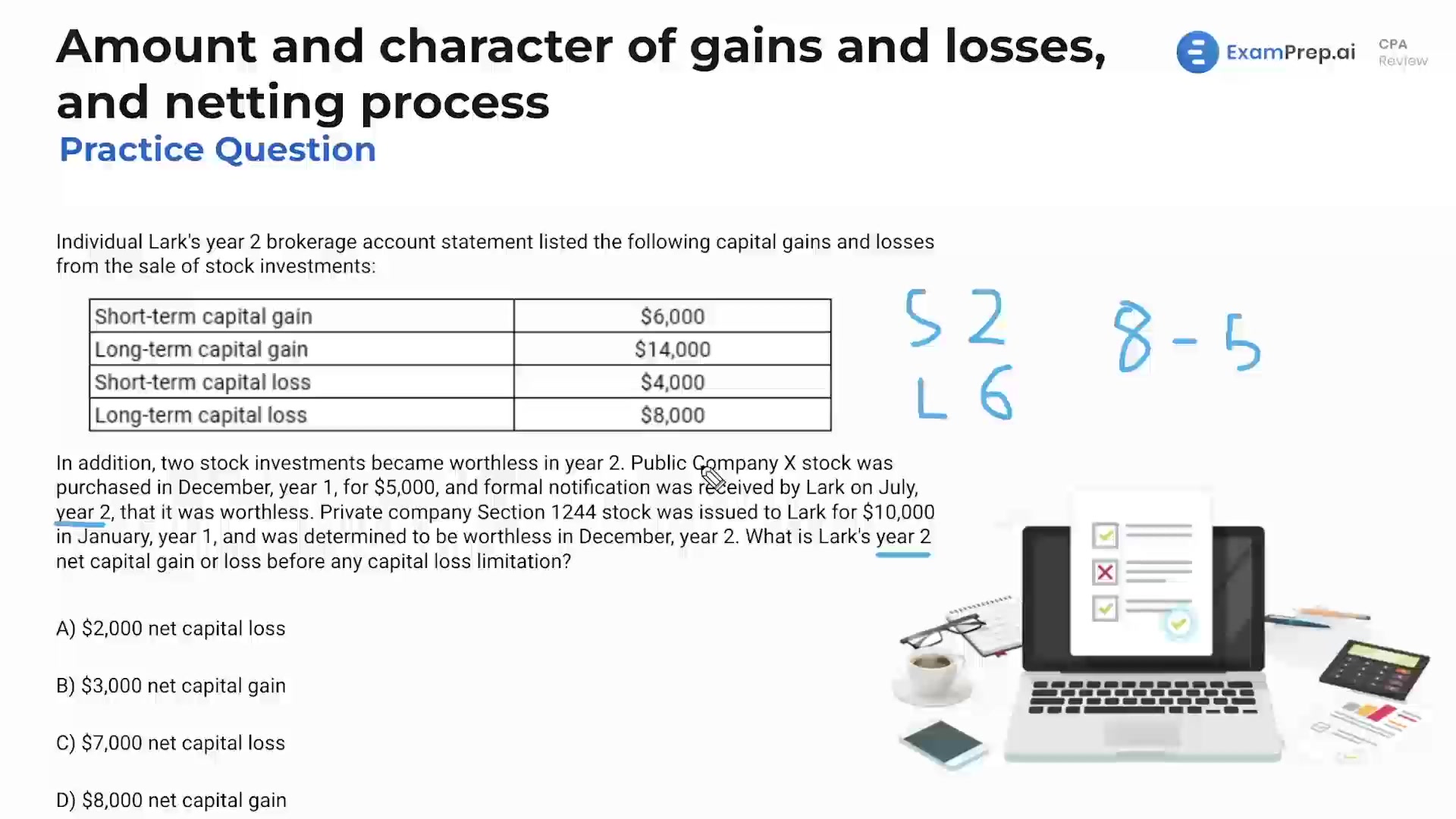

In this lesson, Nick Palazzolo, CPA, dives deep into the intricacies of calculating capital gains and losses, with a focus on the netting process relevant for taxation purposes. He meticulously breaks down practice questions that deal with combining short-term and long-term gains and losses, addressing the specific considerations for section 1244 stock and the distinction between ordinary and capital losses. Nick ensures a comprehensive understanding of the net capital gain or loss before any capital loss limitations, applying the rules to various scenarios, and explaining the annual limit on capital loss deductions against ordinary income, reinforcing the necessity to grasp these concepts for proper tax reporting.

This video and the rest on this topic are available with any paid plan.

See Pricing