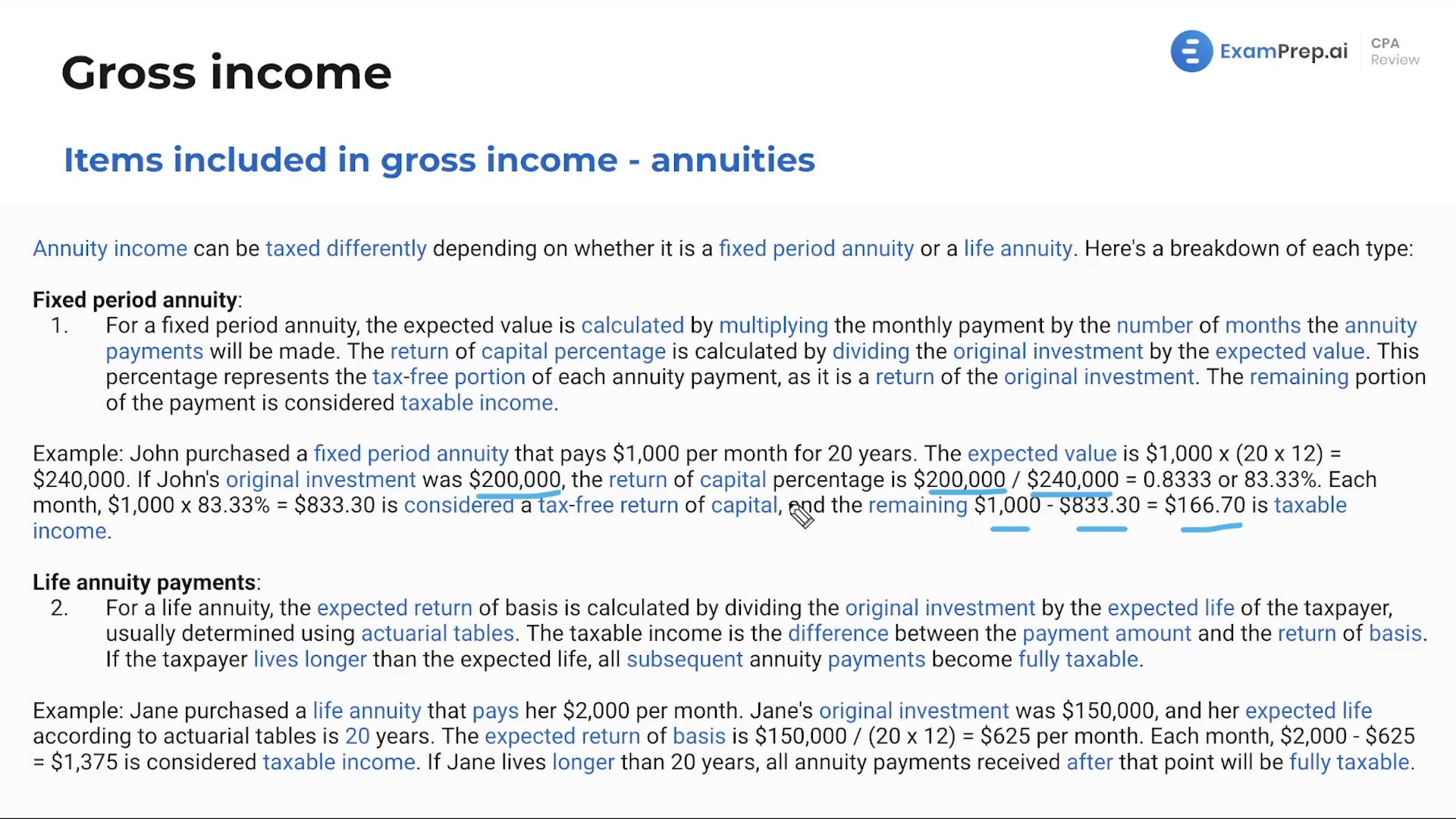

In this lesson, Nick Palazzolo, CPA, breaks down various aspects of annuities and their intersection with taxable income, detailing the specifics of fixed period and life annuities alongside the role of actuaries in this process. With engaging explanations, he dives into calculating the expected value of annuities, the return of capital percentage, and the resultant tax implications for each type of annuity payment. Nick skillfully shows how to determine which portions of these payments are tax-free as opposed to taxable. The session also covers Social Security income, illustrating how combined income affects the taxability of Social Security benefits, all to ensure a comprehensive grasp of these vital retirement income components.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free