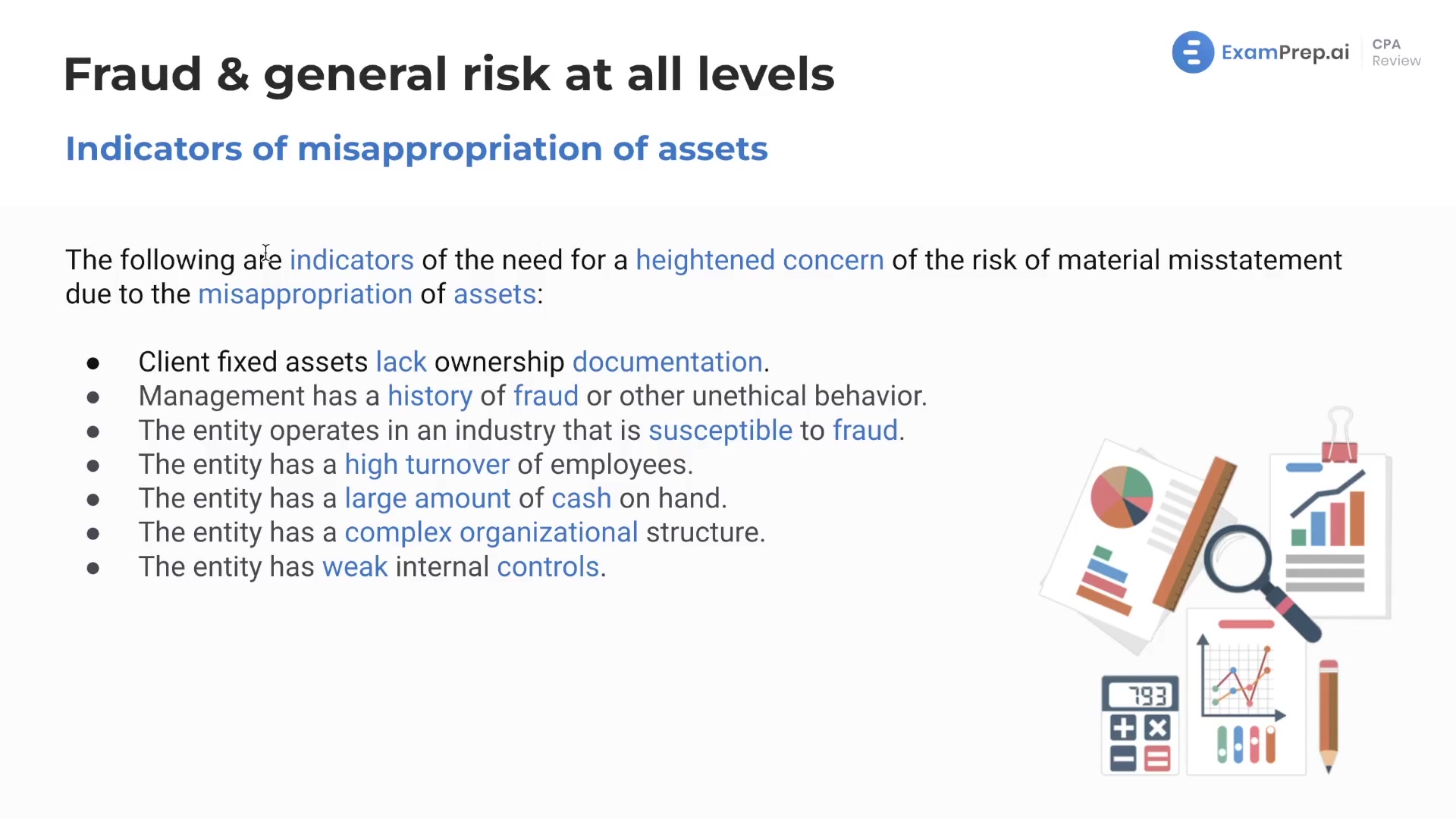

In this lesson, Nick Palazzolo, CPA, discusses the procedures to assess fraud risk during an audit. He covers the importance of conducting interviews with management, the internal audit function, and the audit committee to identify risks of material misstatement due to fraud. He also highlights the presumption of risks within improper revenue recognition and management override of controls. The lesson continues by discussing common risks such as overstated assets, understated liabilities and expenses, and indicators of increased fraud risk as identified by the AICPA. Finally, Nick addresses the importance of obtaining supporting documentation and accounting records during the audit process.

This video and the rest on this topic are available with any paid plan.

See Pricing