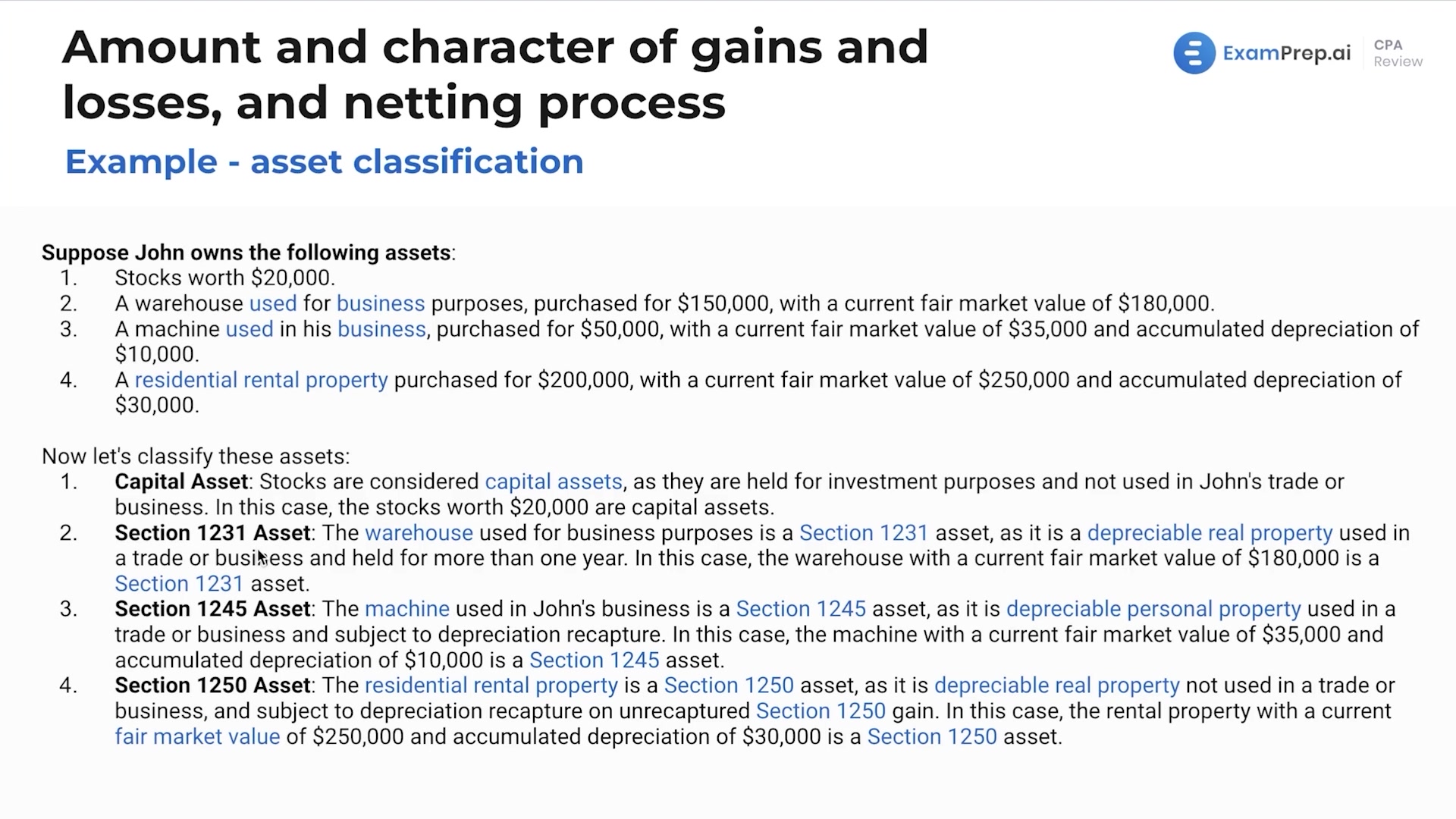

In this lesson, Nick Palazzolo, CPA, dives into the nuances of asset classification, an essential topic for those pursuing an understanding of taxation and financial planning. Featuring a blend of straightforward explanations and practical examples, this lesson differentiates between capital assets like stocks and personal property, non-capital assets such as inventory and depreciable property used in business, and the specifics of like-kind exchanges. Nick engages with scenarios like taxable and non-taxable dispositions and discusses the implications these classifications have on taxation methods. He stresses the importance of memorization when it comes to recognizing various asset categories and their associated tax treatments, including the distinctions between ordinary income and capital gains. By approaching complex sections of the tax code with easy-to-understand examples, Nick ensures that the core concepts of asset classification are thoroughly grasped, enabling a deeper comprehension of how these rules play out in real-world contexts.

This video and the rest on this topic are available with any paid plan.

See Pricing