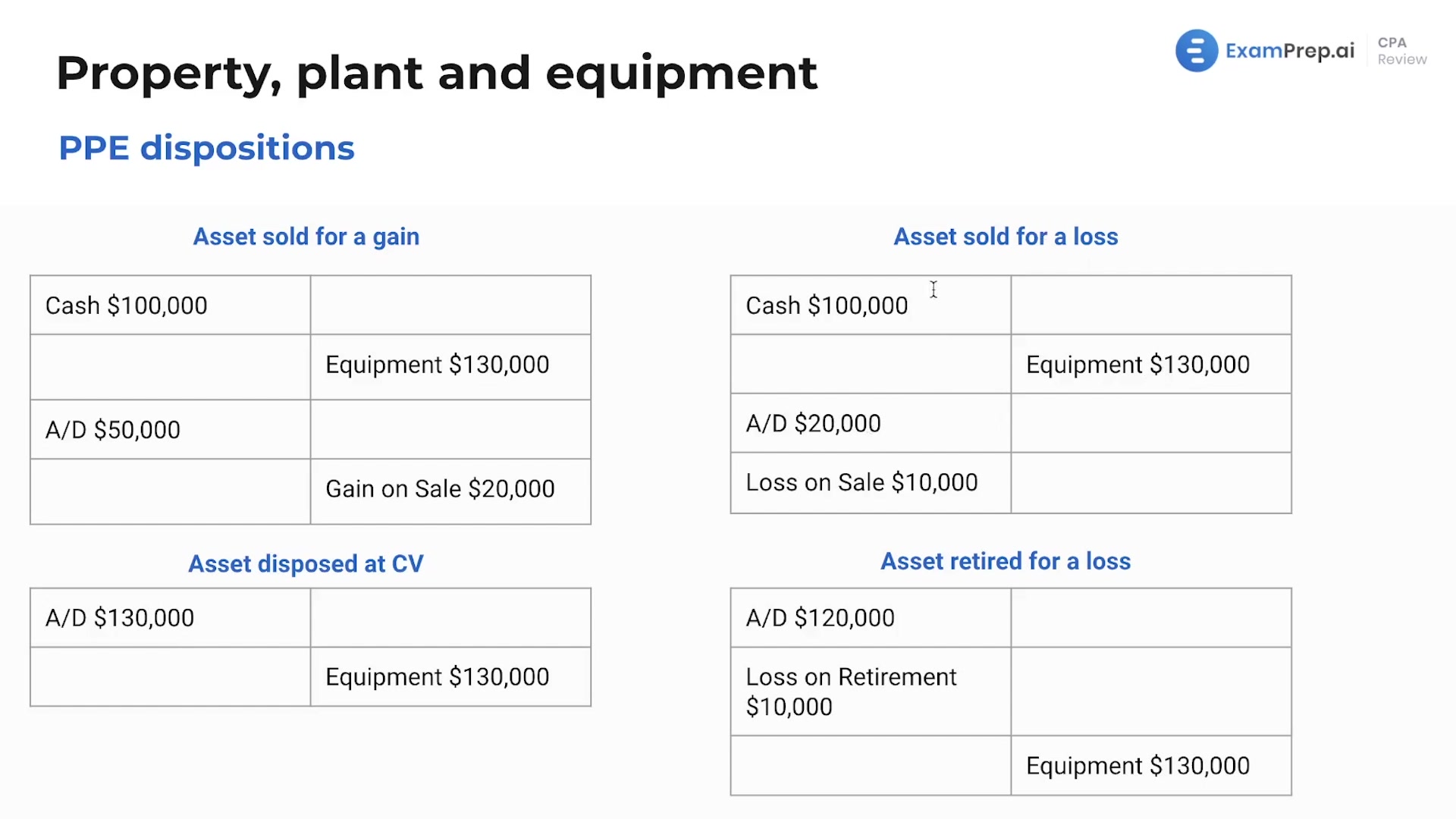

In this lesson, Nick Palazzolo, CPA, demystifies the process of recording journal entries for the disposal of property, plant, and equipment (PP&E). Whether it's selling assets for a gain or a loss, throwing them away, or transferring them off the balance sheet, Nick breaks down the methods for effectively handling each scenario. With practical examples, he demonstrates how to start journal entries with cash transactions, how to credit equipment to remove it from the balance sheet, and how to calculate and account for gains or losses based on the carrying value of the equipment. Watch as Nick guides you through the steps to recognize gains and handle losses, as well as dealing with the disposal of fully or partially depreciated assets. These insights provide a clear understanding of PP&E dispositions and the resulting financial implications.

This video and the rest on this topic are available with any paid plan.

See Pricing