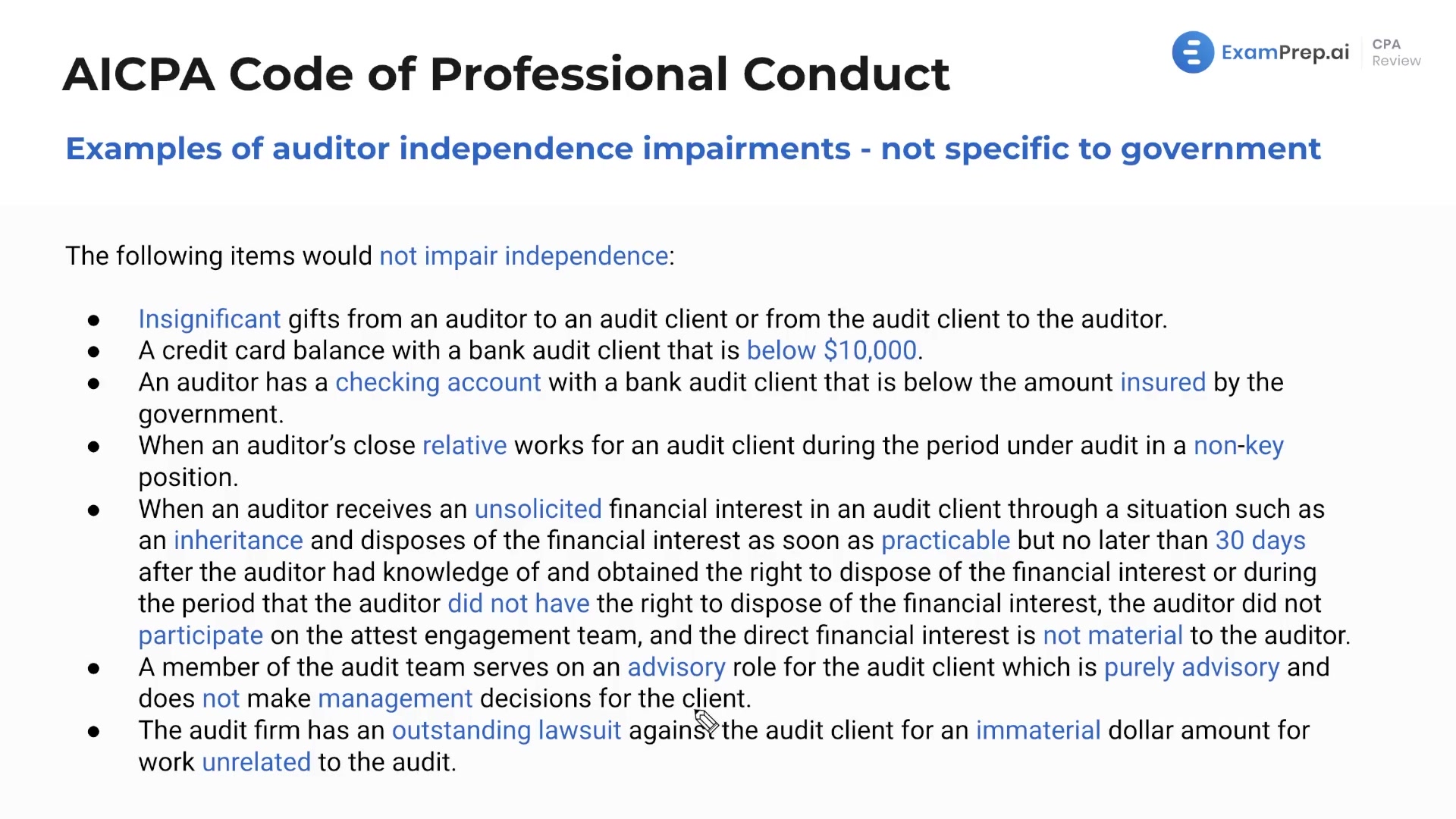

This lesson covers general examples of auditor independence impairments, which play a key role in maintaining the integrity of an audit. Various scenarios are discussed that could compromise an auditor's independence, including accepting significant gifts from the audit client, having a credit card balance or checking account with the bank client that exceeds certain limits, and having a close relative in a key position at the audit client's company. Additionally, the lesson outlines instances where having a direct interest in the audit results, outstanding lawsuits against the audit client, or the intention of the client's management to commence litigation against the audit firm can impact independence. Overall, the lesson reinforces the importance of understanding and avoiding situations that could impair an auditor's independence.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free