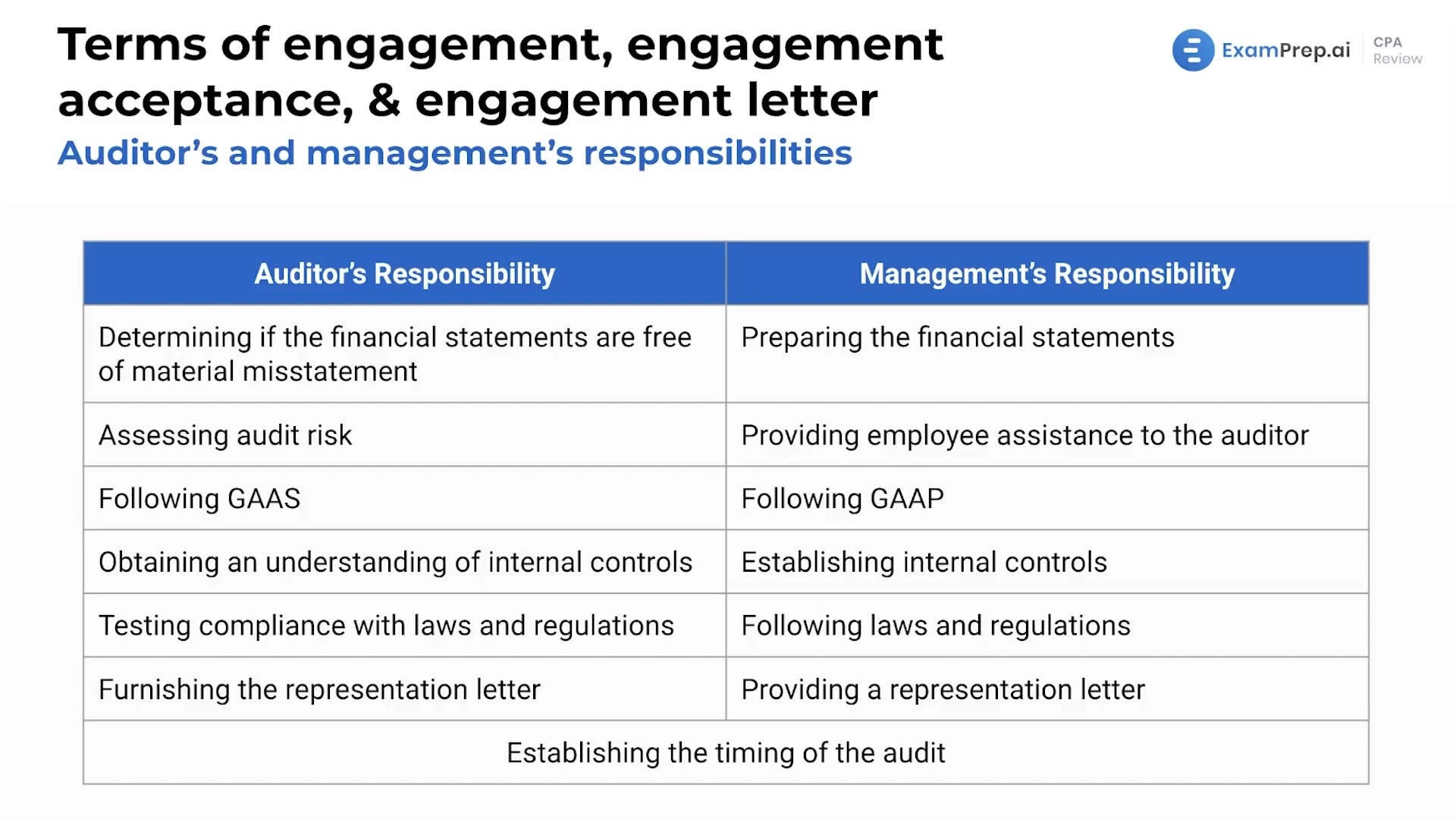

This lesson elucidates the distinct responsibilities of both the auditor and management during an audit engagement. It covers aspects such as providing assurance of financial statements being free from material misstatements, employee assistance, and audit risk assessment. The lesson emphasizes the difference between Generally Accepted Accounting Principles (GAAP) and Generally Accepted Auditing Standards (GAAS) and their respective roles in preparing and auditing financial statements. Additionally, it explains the importance of internal controls, compliance with laws and regulations, and the management representation letter. Finally, the lesson highlights the shared responsibility in determining the timing of the audit.

This video and the rest on this topic are available with any paid plan.

See Pricing