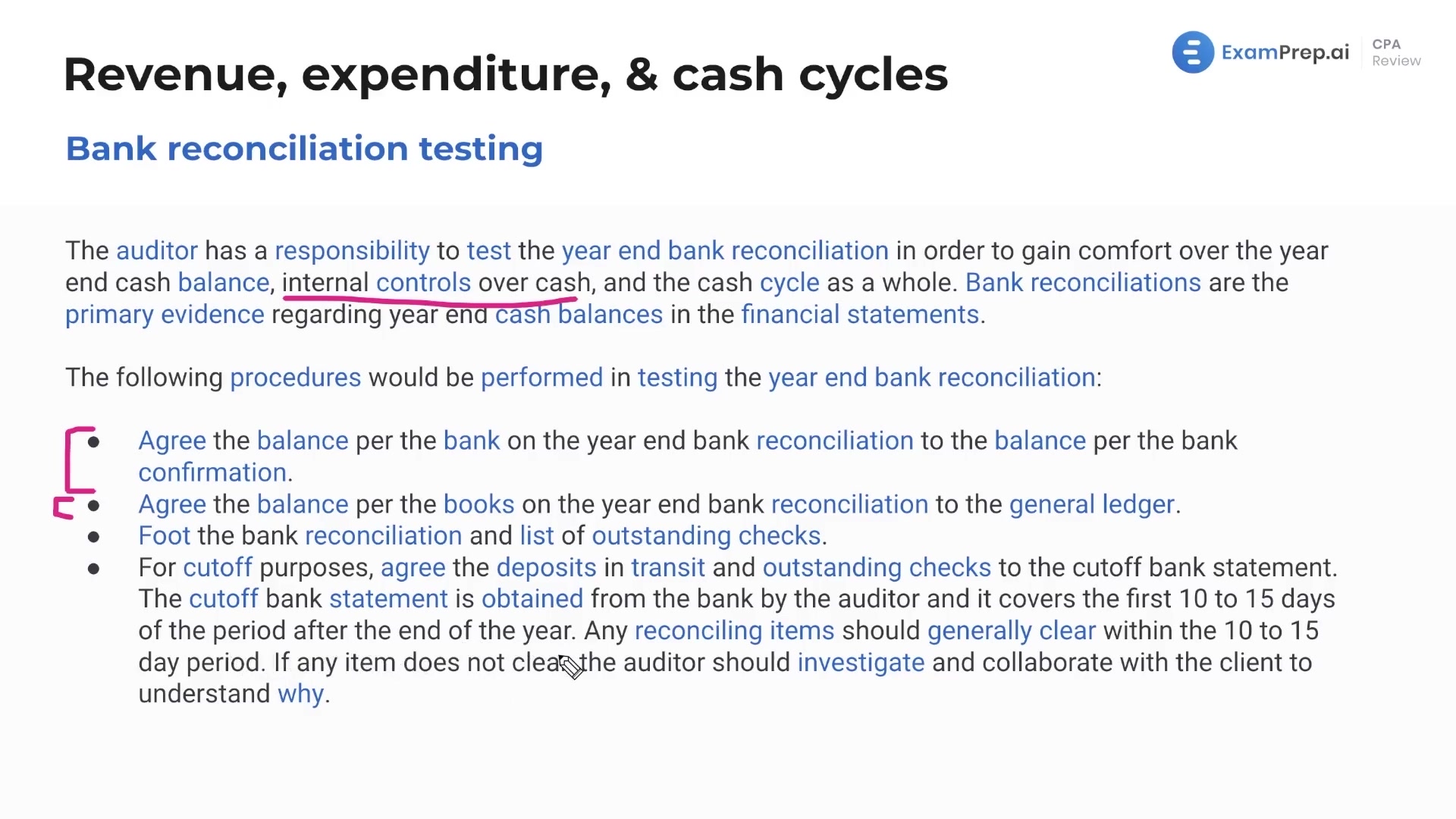

In this lesson, Nick Palazzolo explains the process of bank reconciliation— an important concept to understand for both FAR and Audit. He provides an example of how to match the balances for the bank and books to ensure that they equal each other, using different reconciling items such as interest earned, bank fees, and deposits in transit. Nick guides through each step, clarifying that the reconciliation is part of the financial reports and emphasizing the importance of understanding what each party may not know. By the end of the lesson, viewers will have a better understanding of what a bank reconciliation entails and how to accurately account for any discrepancies between the bank and book balances.

This video and the rest on this topic are available with any paid plan.

See Pricing