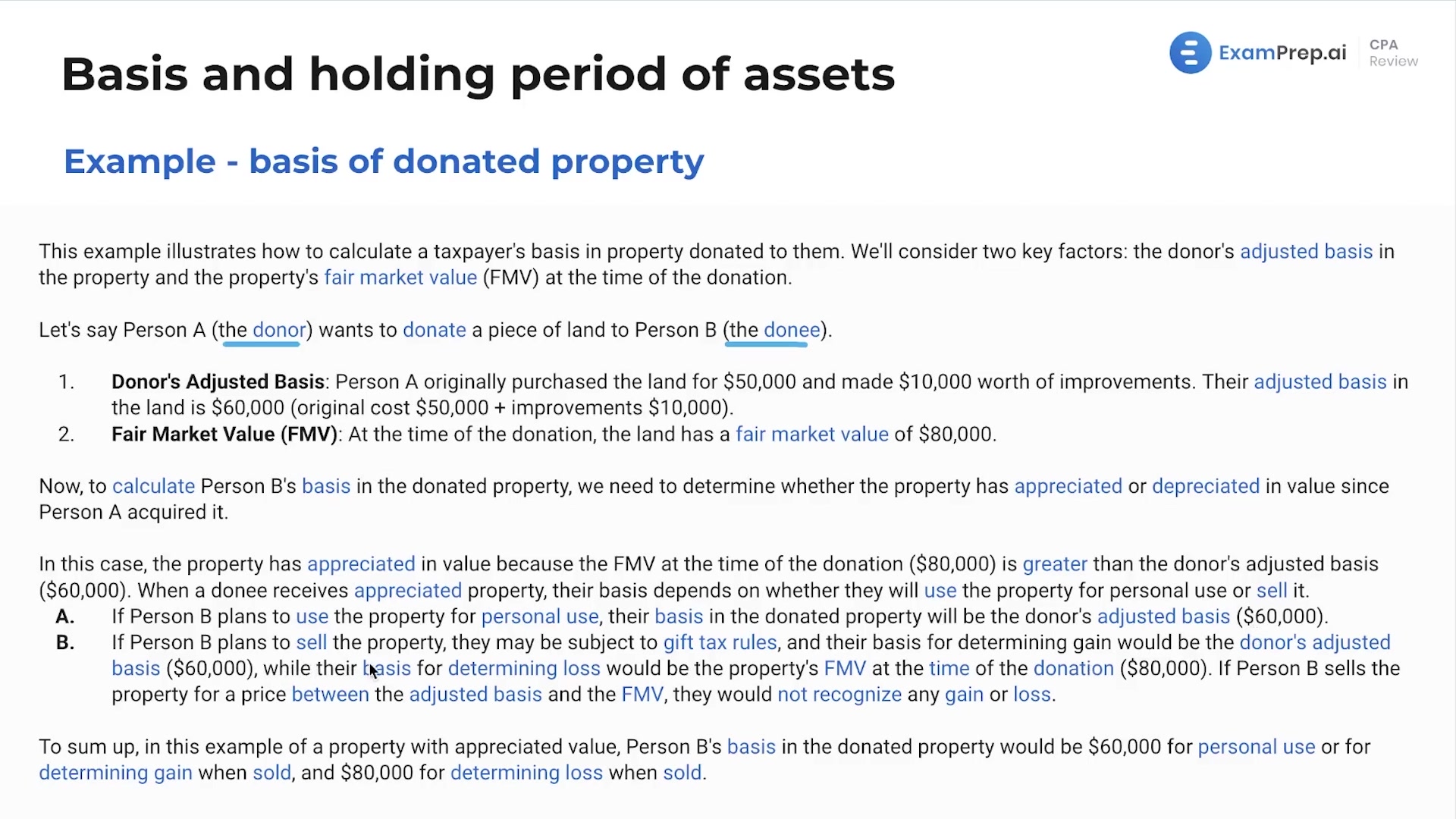

In this lesson, Nick Palazzolo, CPA, breaks down the intriguing topic of donated property basis, beginning with an exploratory question that sets the stage for understanding why and how property might be handed over to another person. He delves into an example that illustrates how to compute a donee's basis in property received as a donation, considering the donor's adjusted basis and the fair market value at the time of donation. Nick presents scenarios where the recipient might use the property personally or sell it, introducing the relevant basis determination rules for each situation. With an easy-to-follow explanation, he navigates through the complexities of appreciated property donations, gift tax implications, and summarizes key points about asset basis and holding periods, empowering with the know-how to master these crucial concepts for tax purposes.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free