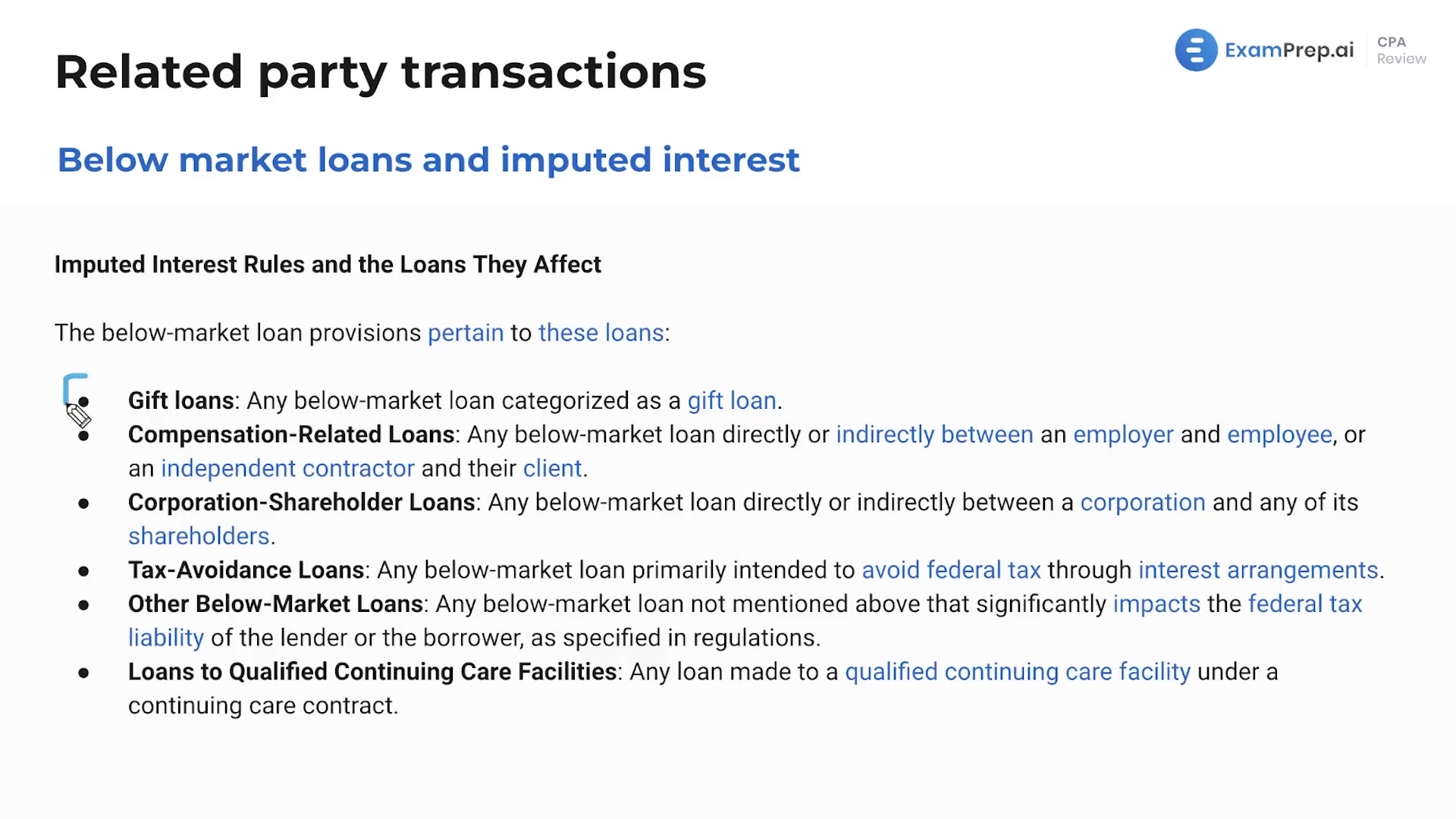

In this lesson, Nick Palazzolo, CPA, navigates the intricacies of below market loans and the concept of imputed interest. He lays out scenarios where individuals or entities provide loans at interest rates below the applicable federal rate (AFR) and how the IRS requires these loans to be treated as if they were made at the market rate. With engaging examples, Nick unravels the instances in which these rules come into play, including loans between family members, employers and employees, shareholders, and more. He also covers exceptions to these rules, such as the de minimis rule for small loans and special provisions for gift loans that don't exceed a certain threshold. The lesson is capped off by breaking down how to practically compute imputed interest with a restructured loan situation, illustrating the real impact on both lenders and borrowers.

This video and the rest on this topic are available with any paid plan.

See Pricing