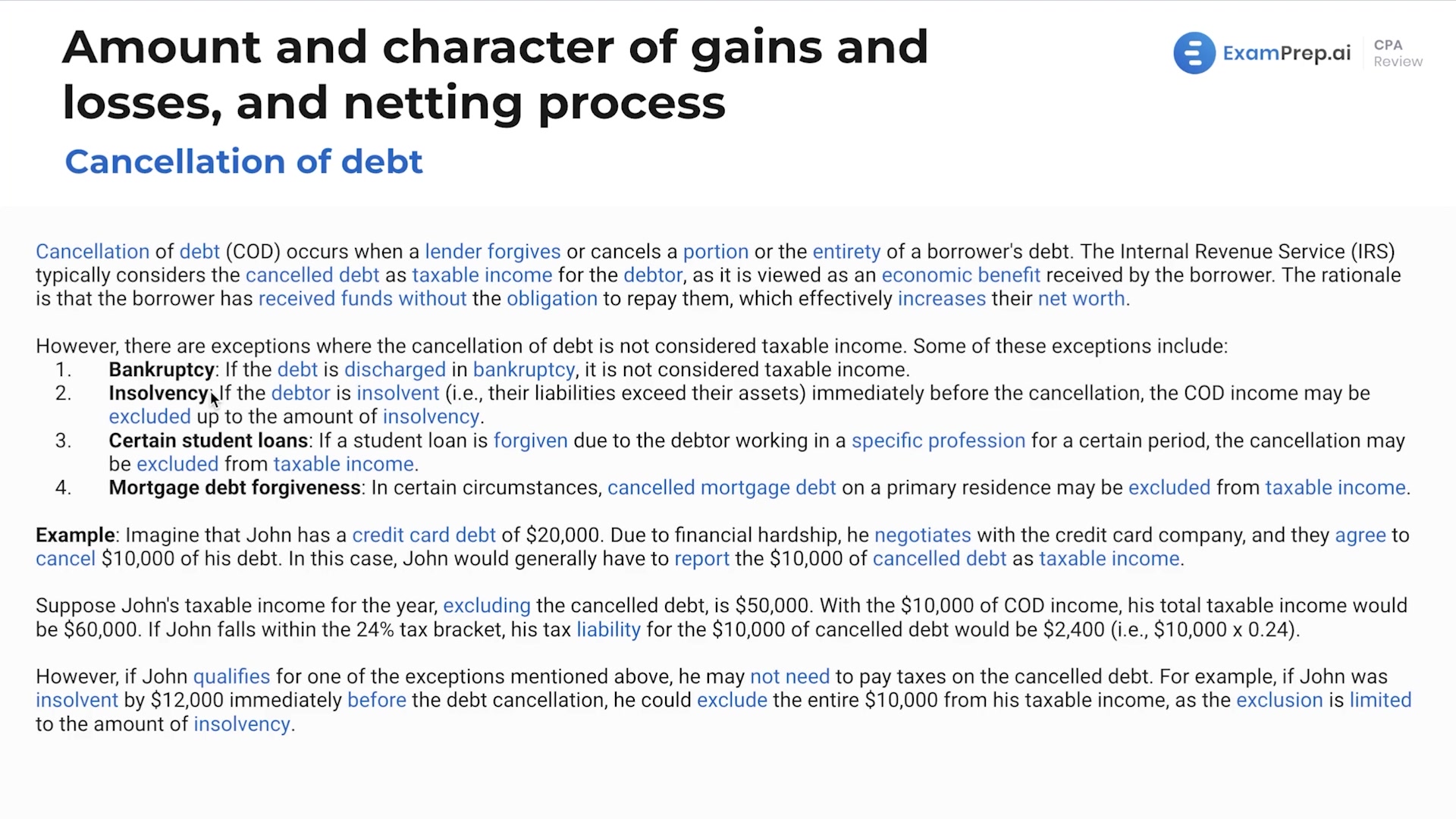

In this lesson, Nick Palazzolo, CPA, unpacks the tax implications of debt cancellation. He begins by illustrating a situation where a portion of debt is forgiven and clarifies that for tax purposes, this relief is treated as if the creditor gave the borrower the money, creating taxable income. Nick dives into the specifics of why the IRS views forgiven debt as an economic benefit, thereby increasing the borrower’s net worth and its exceptions, such as insolvency and certain types of student loan forgiveness. He also offers a practical tip on negotiating debt and provides examples to demonstrate how forgiven debt affects taxable income and potential tax liability, as well as how certain exceptions can aid in avoiding tax on the canceled debt.

This video and the rest on this topic are available with any paid plan.

See Pricing