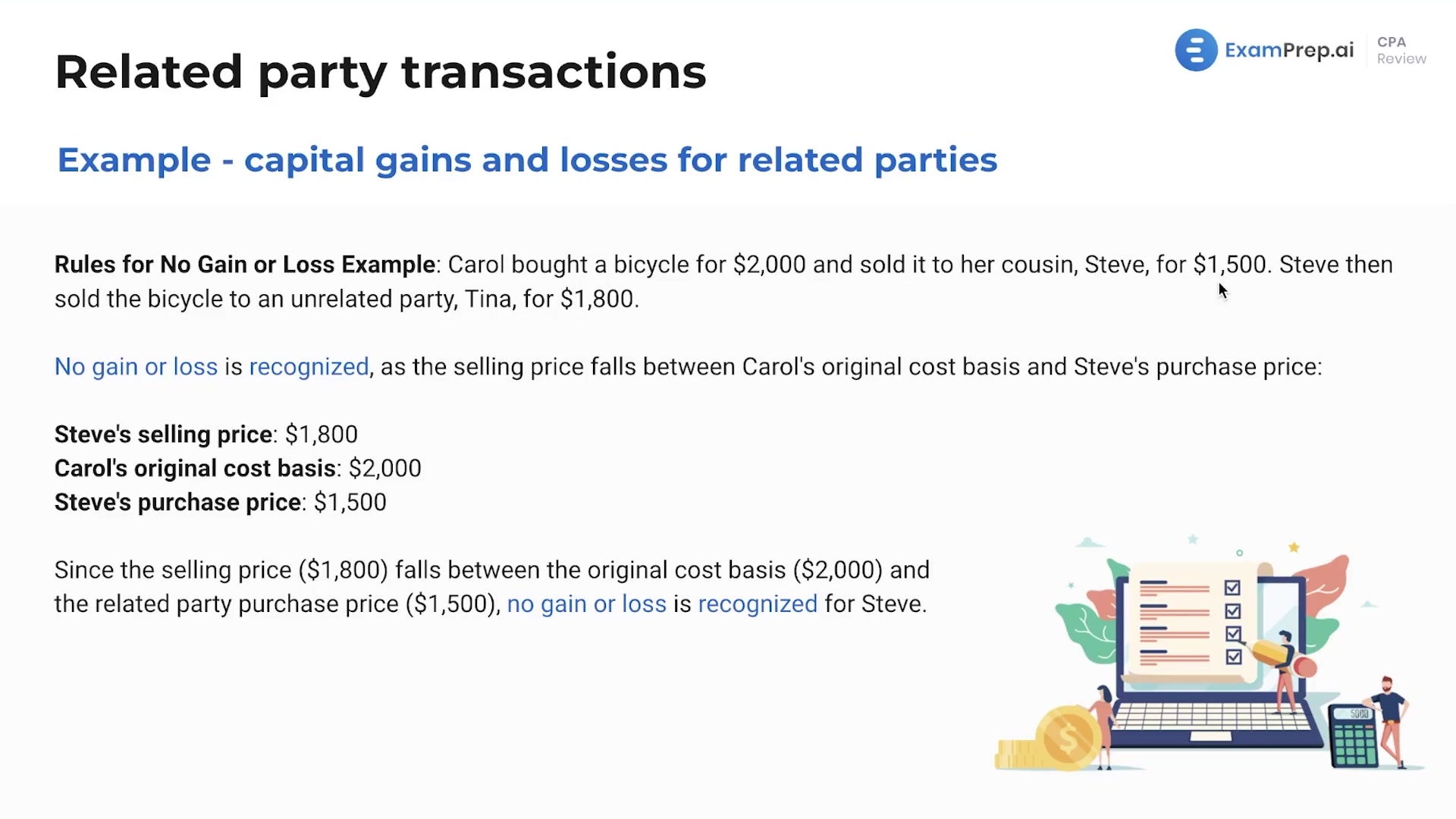

In this lesson, Nick Palazzolo, CPA, breaks down the intricate rules surrounding capital gains and losses for transactions between related parties. He navigates through the complexities of tax implications for sales involving non-depreciable assets, explaining exceptions, basis rules, and the intricate nuances of gain and loss recognition. Nick elucidates the mechanism of selecting the middle number when considering the basis and consequent gain or loss for a subsequent sale by a related party, illustrating his points with practical examples. He provides clear guidelines for recognizing gains only when the sale price exceeds the former relative's cost basis and highlights the need to understand the rules for instances where no gain or loss is recognized. The lesson is rich with examples that link theory with the actual calculation of basis and recognition of gains or losses, reinforcing the key concepts through visual learning.

This video and the rest on this topic are available with any paid plan.

See Pricing