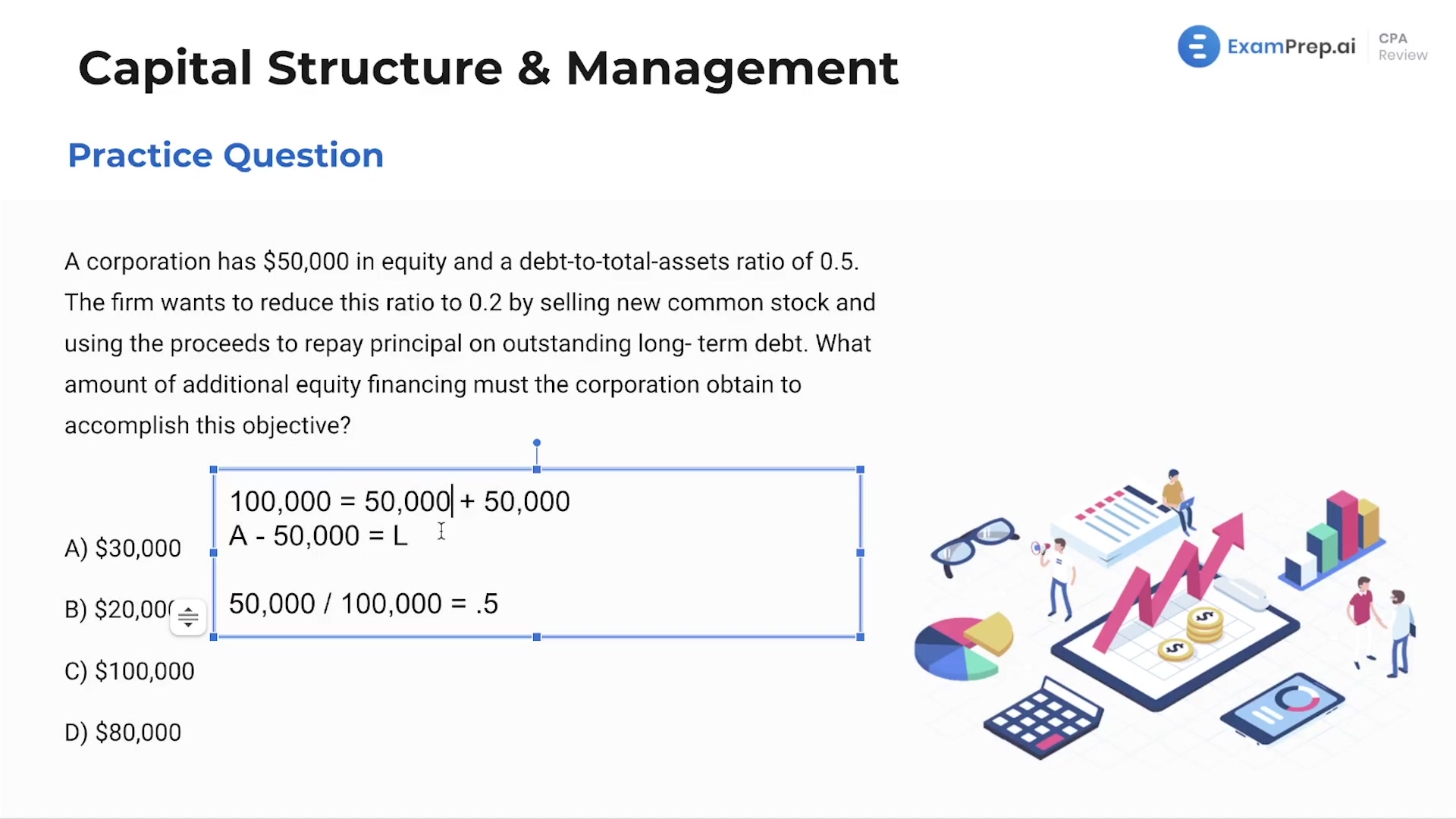

In this lesson, join Nick Palazzolo, CPA, as he tackles multiple choice questions that demystify the elements of capital structure and management. He begins by examining the components that make up the weighted average cost of capital (WACC) formula, emphasizing its importance and breaking down each segment, from cost of debt to cost of equity and preferred stock. Nick also delves into the intricacies of the capital asset pricing model (CAPM), reinforcing the need to understand and memorize these crucial formulae for success. As the practice questions get more complex, involving the debt-to-asset ratio and strategic equity financing, Nick methodically explains the calculations and journal entries necessary to navigate these challenges. By the end of this lesson, not only will the formulas and concepts be clearer, but also the strategic thinking needed to apply theoretical knowledge to practical scenarios will be strengthened.

This video and the rest on this topic are available with any paid plan.

See Pricing