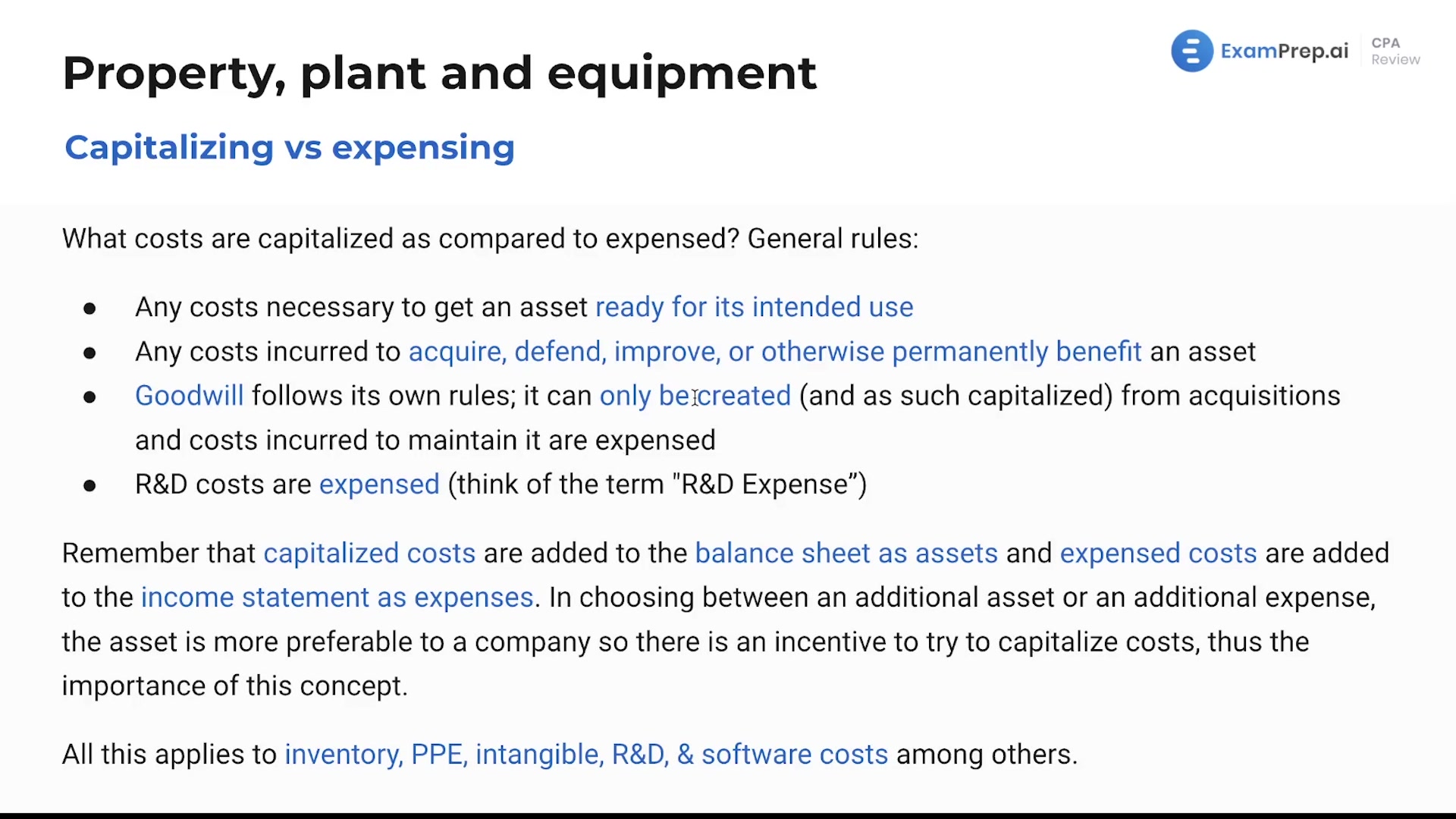

In this lesson, Nick Palazzolo, CPA, delves into the intricate decisions between capitalizing and expensing costs, particularly with a lens on COVID-19 related expenditures. He outlines the general rules applied to various costs such as shipping, installation, and legal fees—all pivotal to preparing an asset for its intended purpose—and details the circumstances under which they're better suited to capitalization. Nick further clarifies the unique treatment of goodwill as an intangible asset and the automatic expensing of R&D costs. By the end of the lesson, a clearer picture emerges on how capitalized costs are added to the balance sheet, while expensed costs impact the income statement, emphasizing the strategic financial impact these choices have for a company’s financial position.

This video and the rest on this topic are available with any paid plan.

See Pricing