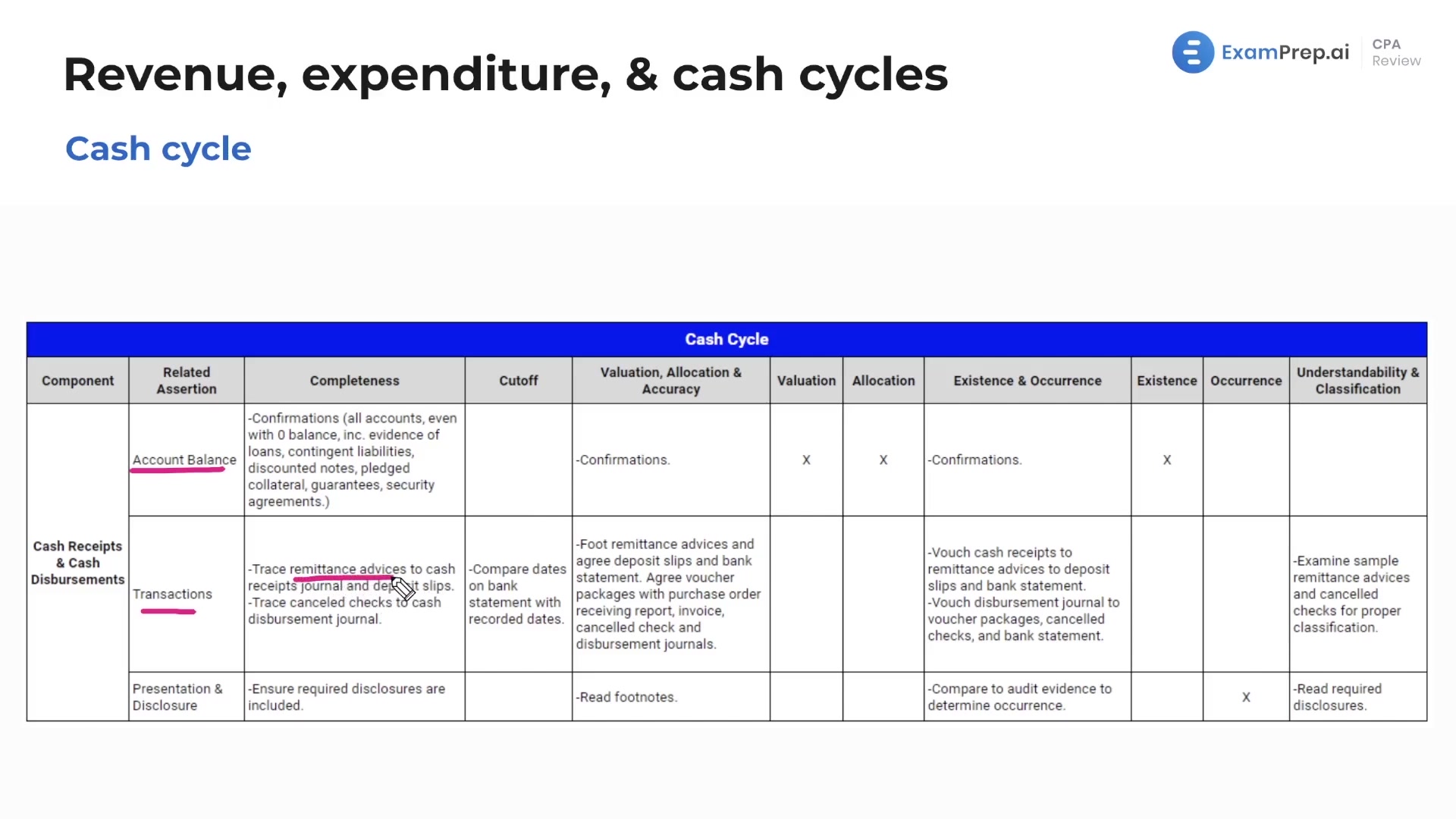

In this lesson, the cash cycle is thoroughly analyzed, covering key aspects such as cash receipts and disbursements, and how these intertwine with the revenue and expenditure cycles. The lesson explores various audit assertions related to the cash cycle, including completeness, valuation, accuracy, and existence. To ensure these assertions are met, several audit procedures are discussed, such as sending confirmations to banks, tracing remittance advices, comparing dates on bank statements, and ensuring proper classification of transactions. Finally, the importance of reviewing footnotes and disclosures for an accurate presentation of the cash cycle is discussed. This lesson provides a comprehensive understanding of the cash cycle and its relationship with other business cycles in an audit context.

This video and the rest on this topic are available with any paid plan.

See Pricing