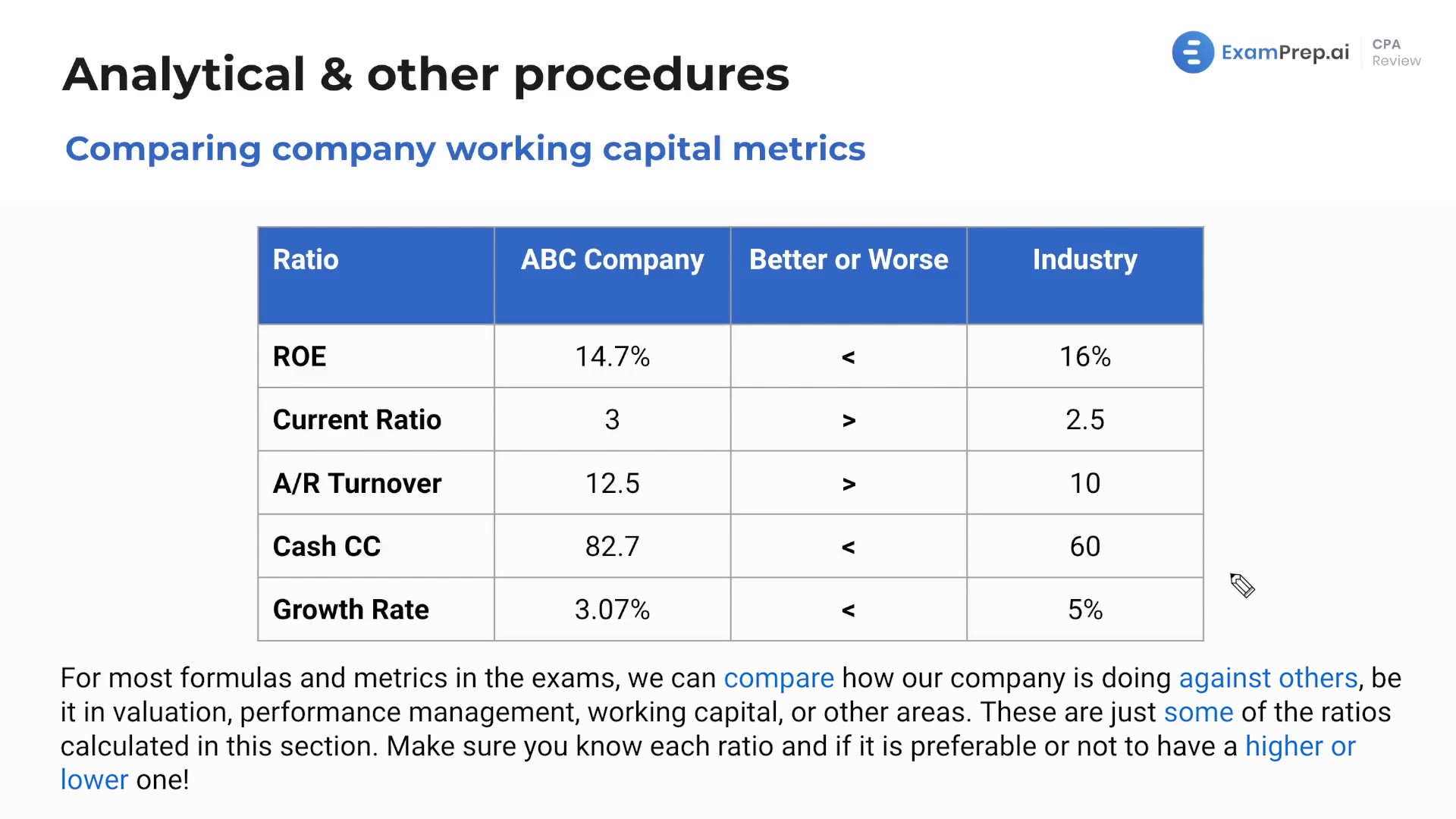

In this lesson, Nick Palazzolo highlights the importance of comparing working capital metrics for audit purposes. He discusses various ratios such as return on equity, current ratio, AR turnover, cash conversion cycle, and growth rate while explaining whether it's preferable to have the ratio be higher or lower. Nick also emphasizes the significance of understanding these relationships in an audit and provides examples on how to analyze the current year and prior year balances to identify any notable differences. The lesson ends with a reminder of the importance of conducting analytical procedures related to revenue, due to its high risk and potential for overstatement, and notes that this could also relate to managers seeking performance-related bonuses.

This video and the rest on this topic are available with any paid plan.

See Pricing