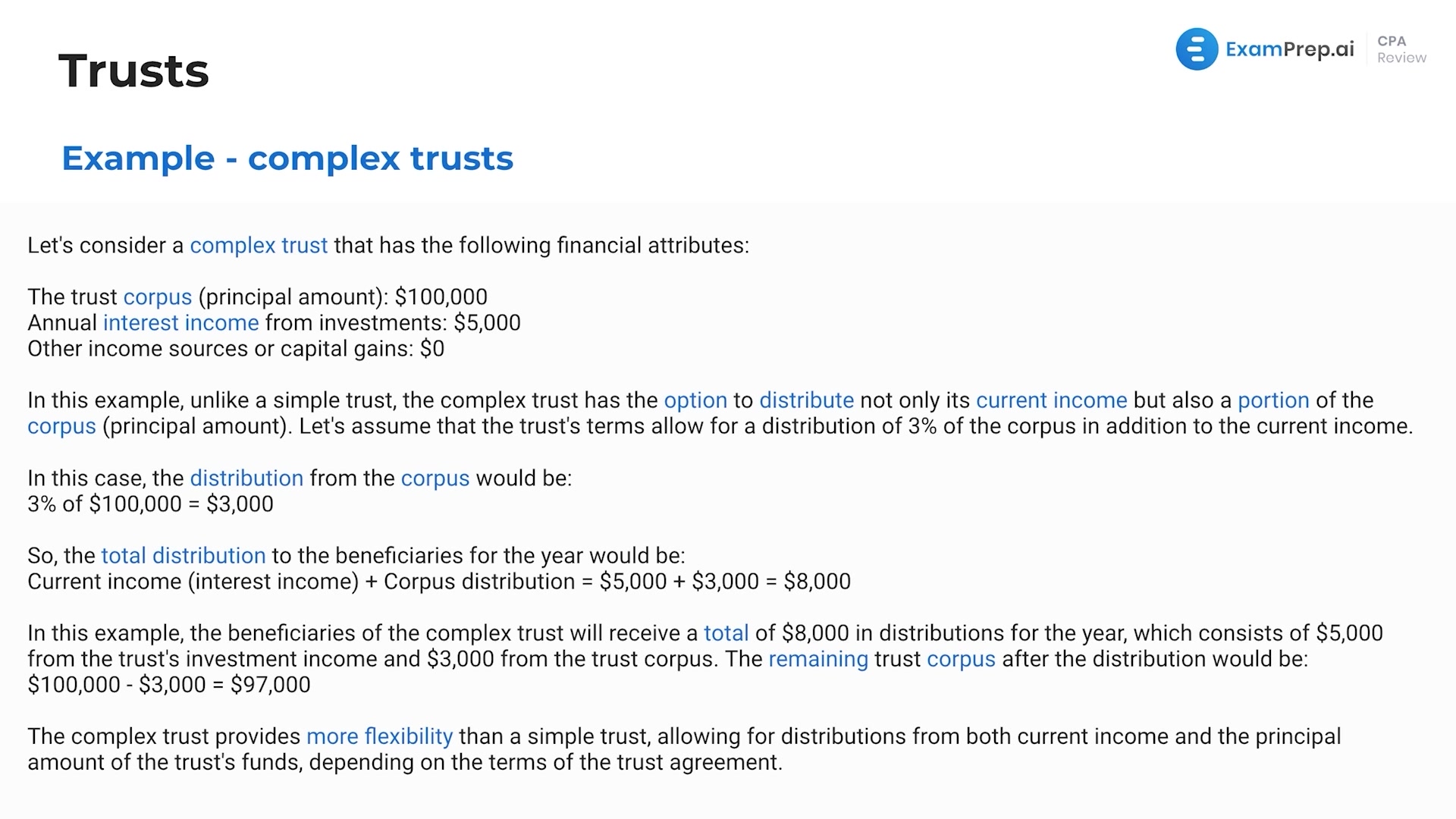

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of complex trusts, explaining how they differ from simple trusts, particularly in their ability to retain income and make distributions from both income and principal. He breaks down the taxation aspect, emphasizing that retained income is often taxed at a higher trust tax rate. Nick provides a realistic scenario to illustrate the administration and purpose of setting up a complex trust, including potential management fees and the trust’s functionality. Also, he underlines the importance of understanding these concepts for the exam, not only for their practical application but also as an opportunity to earn points through memorization. Nick walks through a concrete example, using figures to clarify the distribution of corpus and interest income, making the operation of a complex trust vivid and relatable.

This video and the rest on this topic are available with any paid plan.

See Pricing