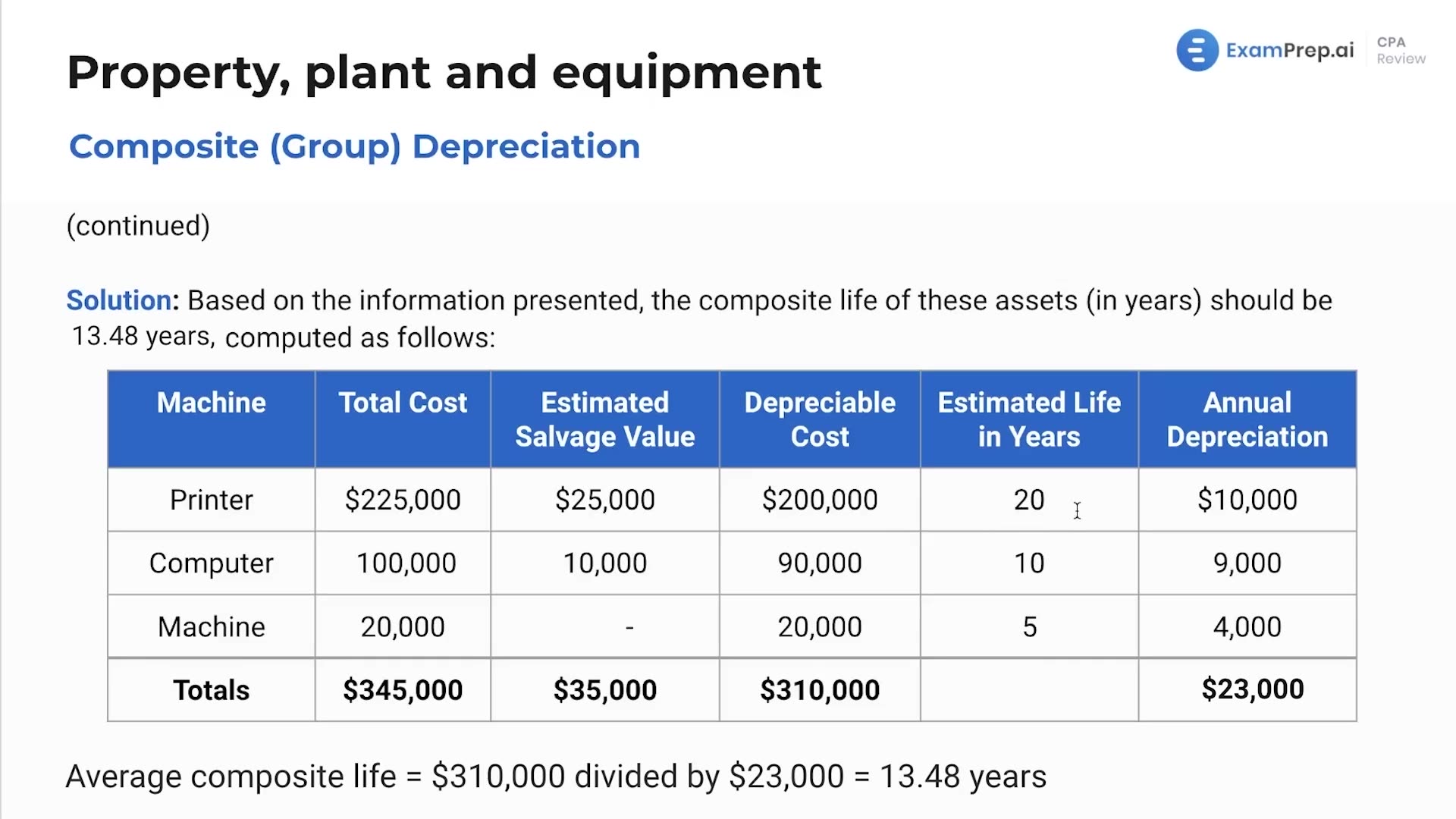

In this lesson, dive into the practicalities of composite or group depreciation with Nick Palazzolo, CPA. Nick brings the concept to life through a hands-on example featuring a packaging company, Holdner. He simplifies the complexities of calculating depreciation for a group of assets, emphasizing the elimination of salvage value to determine a total depreciable cost. Through the lesson, watch as real numbers are crunched to show how to individually compute annual depreciation for each asset, and discover the rationale behind using a weighted average to figure out the total years for depreciation. Perfect for wrapping your head around composite depreciation, this session is invaluable for honing the skills necessary for tackling similar test questions.

This video and the rest on this topic are available with any paid plan.

See Pricing