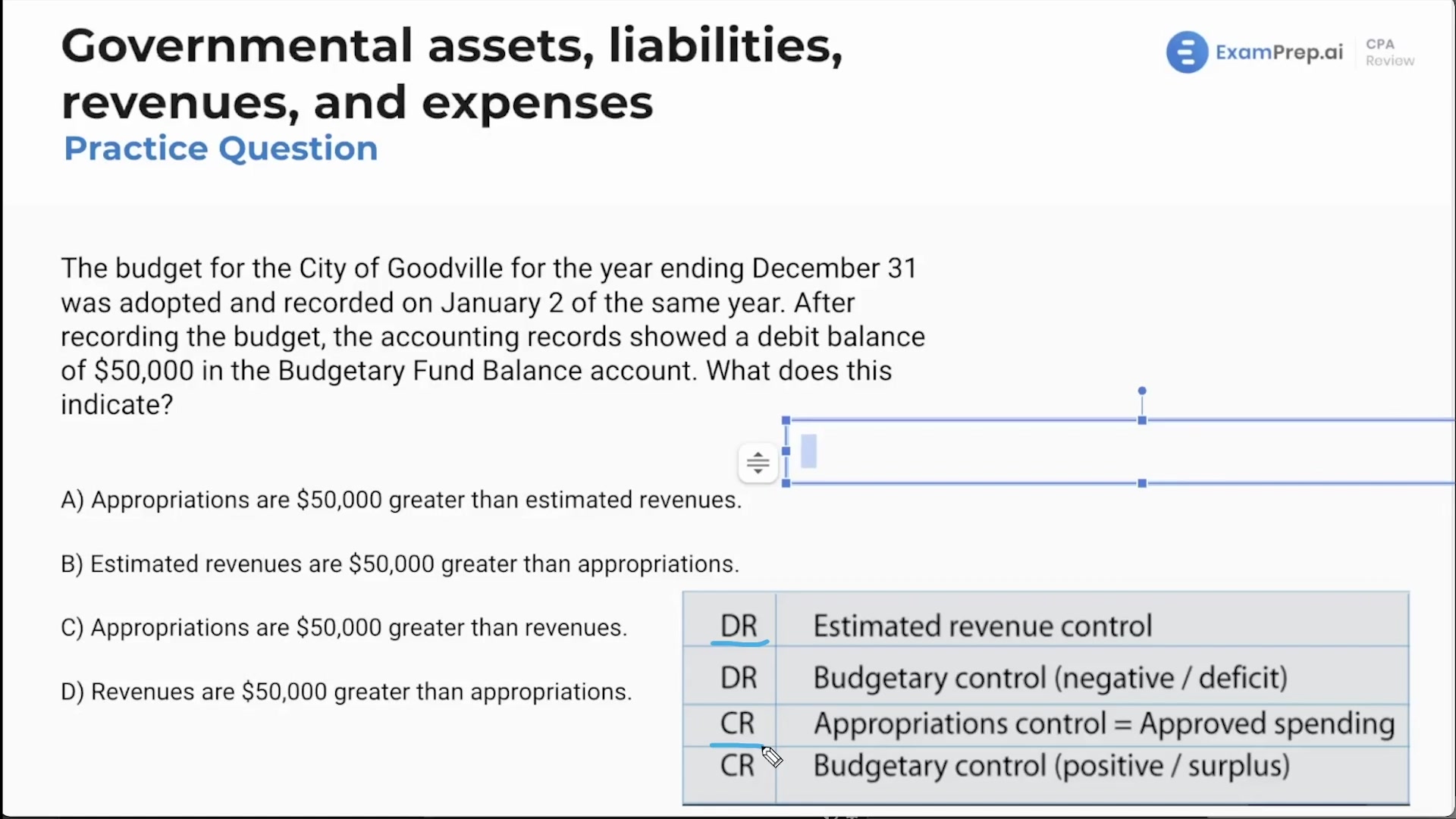

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of governmental accounting, focusing on assets, liabilities, revenues, and expenses as they relate to governmental funds rather than traditional business accounting. You'll explore how the acquisition of a new police car is reported in a government fund statement and why the term 'expenditure' is used instead of 'expense'. Nick also demystifies the meaning behind a debit balance in the budgetary fund balance account, providing a step-by-step walkthrough of budget entries. To further clarify the government-wide financial statement conversion process, he explains which activities should be excluded, particularly highlighting the treatment of fiduciary activities. Emphasizing practical techniques for mastering these concepts, Nick encourages a holistic approach to studying to maintain well-being throughout the journey of passing the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing