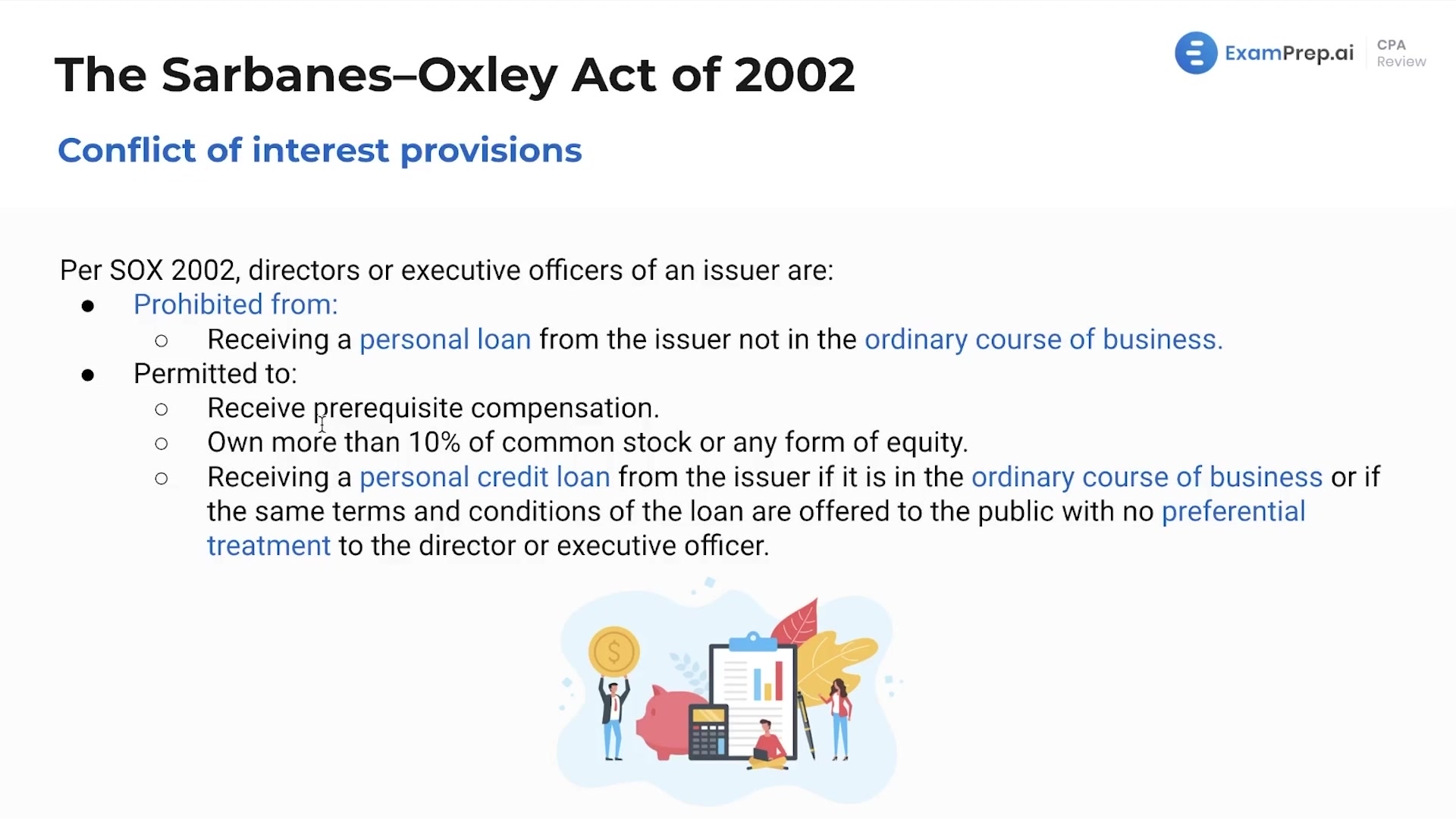

In this lesson, Nick Palazzolo, CPA, demystifies the regulations surrounding conflict of interest provisions, particularly in the context of corporate governance and executive compensation. Using JPMorgan Chase as an illustrative example, he explains what constitutes a conflict of interest, detailing what company directors and executive officers can and cannot do with regards to receiving loans or owning company stock. Nick clarifies the nuances of permitted activities, such as receiving standard forms of compensation approved by shareholders and participating in personal credit loans under ordinary business terms. He highlights the importance of avoiding preferential treatments and ensures that these complex rules are comprehensible, spotlighting potential exam scenarios that might be designed to trip up the unwary.

This video and the rest on this topic are available with any paid plan.

See Pricing