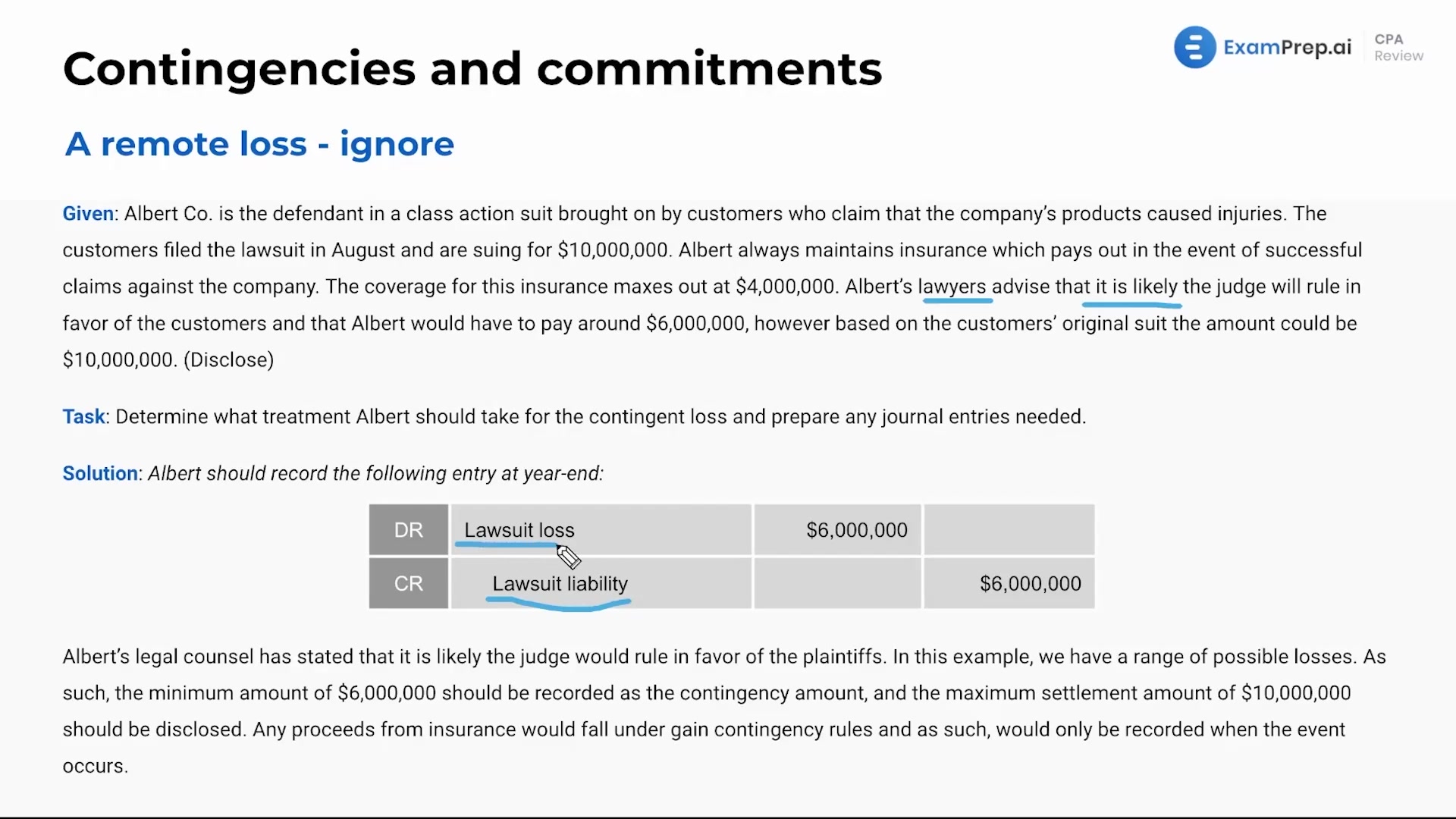

In this lesson, Nick Palazzolo, CPA, delves into how to address and record contingencies and commitments, using the case of Albert Company's class action lawsuit as a practical example. As he assesses the $10 million lawsuit and the company's insurance coverage, Nick explains the process of creating journal entries to record the probable liability. He clarifies when and how to recognize losses in financial statements and emphasizes the importance of disclosure about potential loss ranges. By the end of this lesson, the key steps to account for contingencies, such as identifying the minimum amount to be recorded and accounting for insurance proceeds, are unpacked, ensuring a clear understanding of both the technical requirements and the rationale behind the accounting treatments.

This video and the rest on this topic are available with any paid plan.

See Pricing