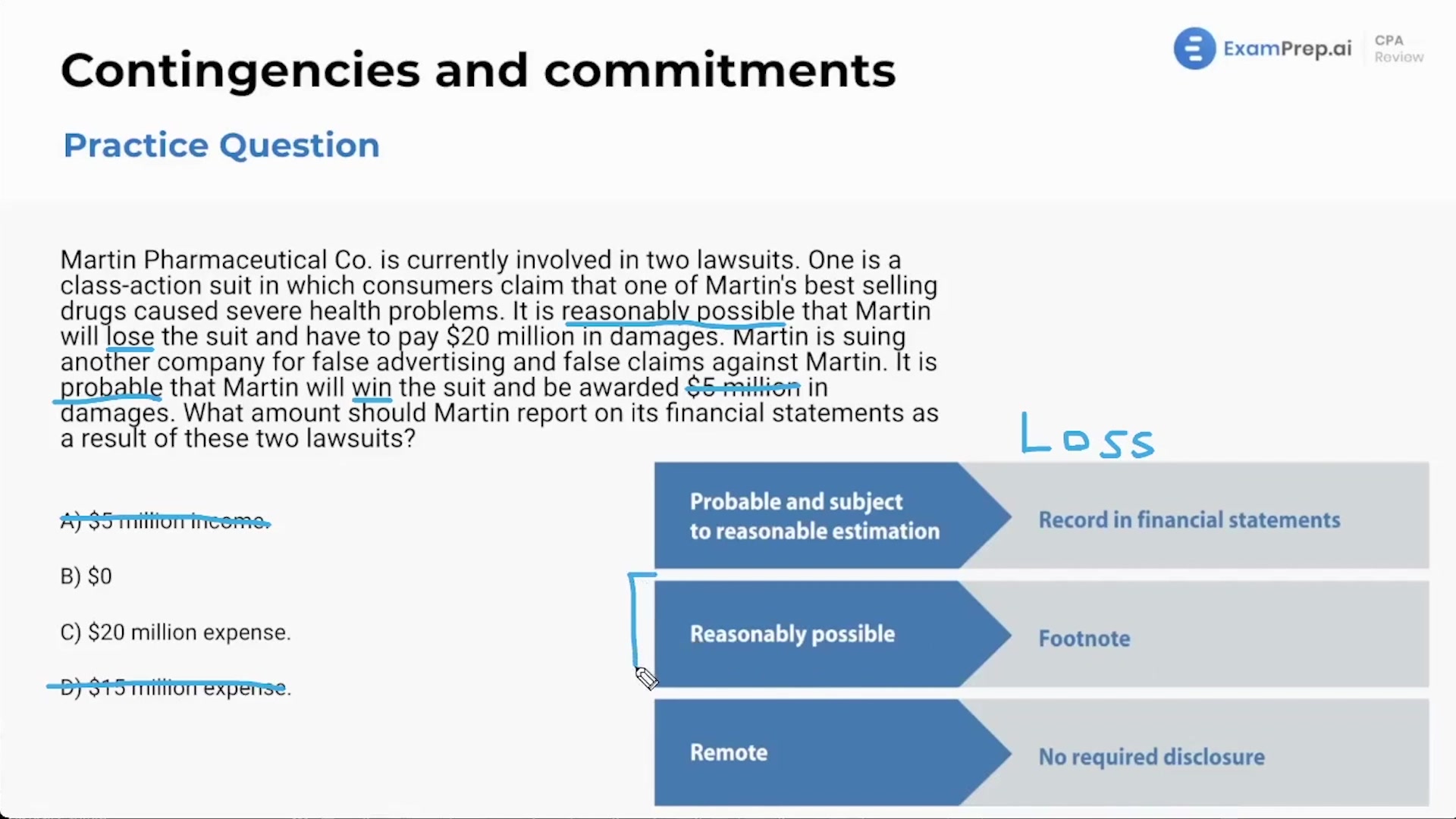

In this lesson, Nick Palazzolo, CPA, delves into the nuanced topic of accounting for contingencies and commitments with a set of practice questions designed to clarify when and how to report losses and gains in financial statements. With his signature engaging style, he tackles tricky scenarios involving legal disputes and potential financial outcomes, unpacking the criteria that determine whether an event should be disclosed in footnotes or recognized in the financial reports. Through the exploration of specific cases, such as a lawsuit loss that's 'reasonably possible' and a probable lawsuit gain, Nick illustrates the proper ways to reflect these uncertainties, emphasizing the difference between mere possibility and actual realization. Expect practical tips and clear explanations to navigate the complexities of recording contingencies, armed with the knowledge to ace these types of questions when they arise.

This video and the rest on this topic are available with any paid plan.

See Pricing