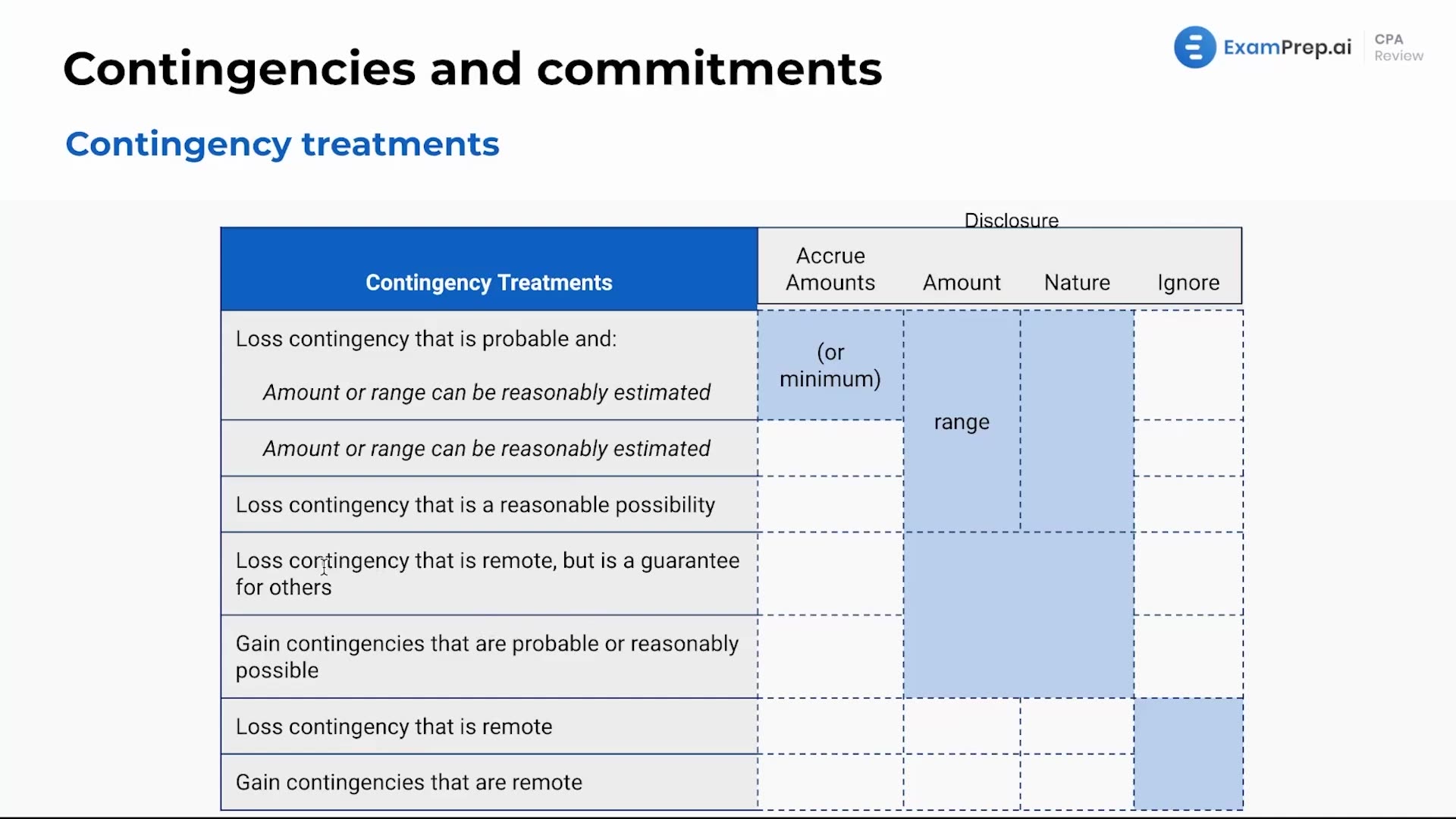

In this lesson, delve into the intricacies of accounting for contingencies with Nick Palazzolo, CPA, as he simplifies this intricate topic. Covering the gauntlet from loss to gain contingencies, Nick breaks down the conditions that warrant an accrual in financial statements, such as probable loss contingencies with estimable amounts, versus those that only require disclosure, like reasonably possible losses or guarantees made for others. He clarifies that while probable or reasonably possible gains receive disclosures, remote contingencies can be left out of the picture entirely. Nick's explanation assists in understanding how to factor different types of contingencies into financial reporting, keeping practices aligned with accounting standards.

This video and the rest on this topic are available with any paid plan.

See Pricing