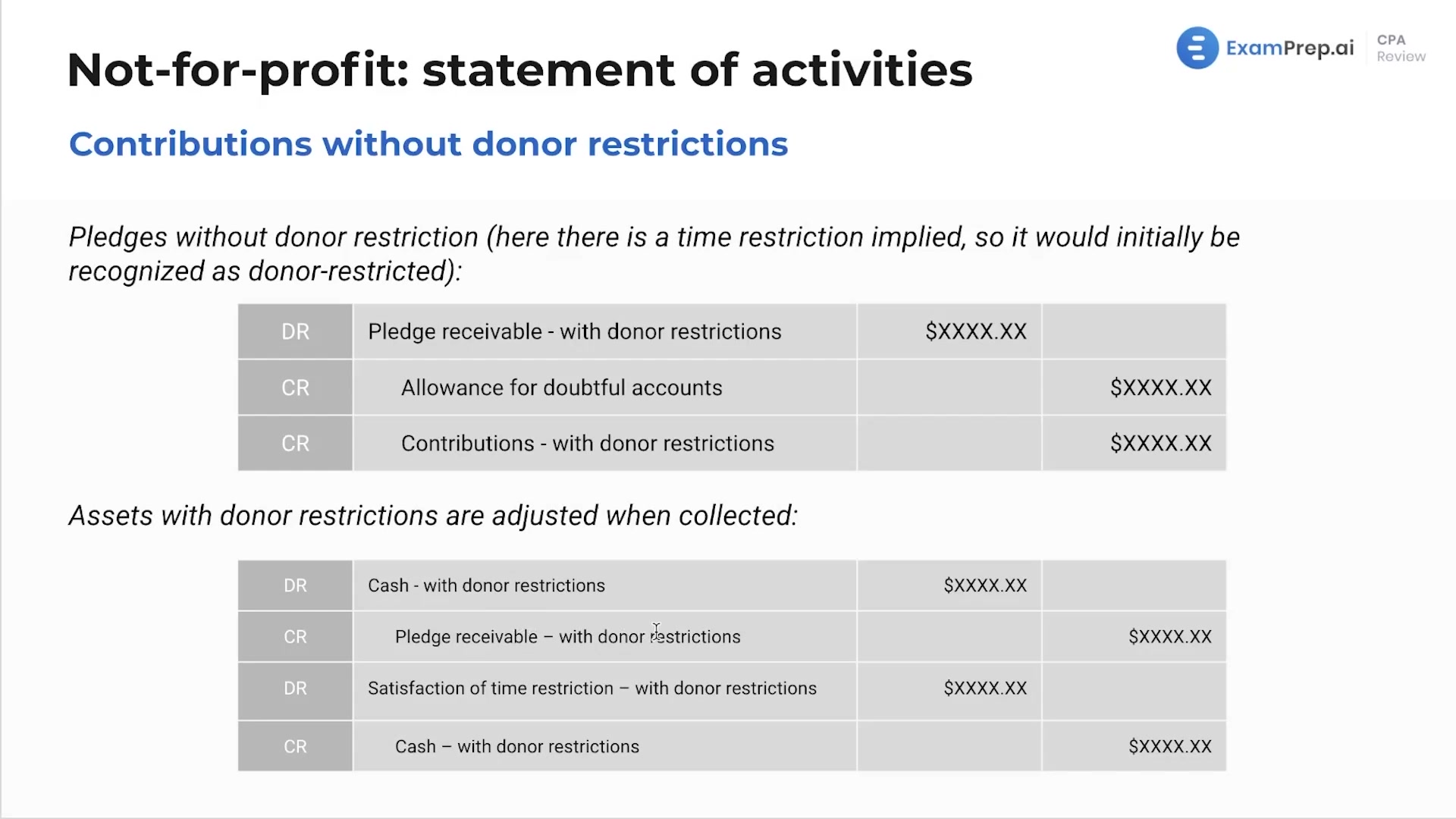

In this lesson, dive into the ins and outs of contributions without donor restrictions, where Nick Palazzolo, CPA, demystifies the accounting process for these transactions. Nick ensures everything is digestible, from understanding pledges and receivables to journal entries akin to those in corporate accounting. Highlighting the similarities to familiar accounting concepts, this lesson is all about building confidence in navigating these contributions—unpacking the nuances of recognizing pledges, assessing allowances for doubtful accounts, and recording assets. Get ready to connect the dots to corporate accounting practices and take a closer look at the journal entries that are crucial for mastering this area. Remember, there's no need to memorize—familiarity is the key to handling exam questions with poise.

This video and the rest on this topic are available with any paid plan.

See Pricing