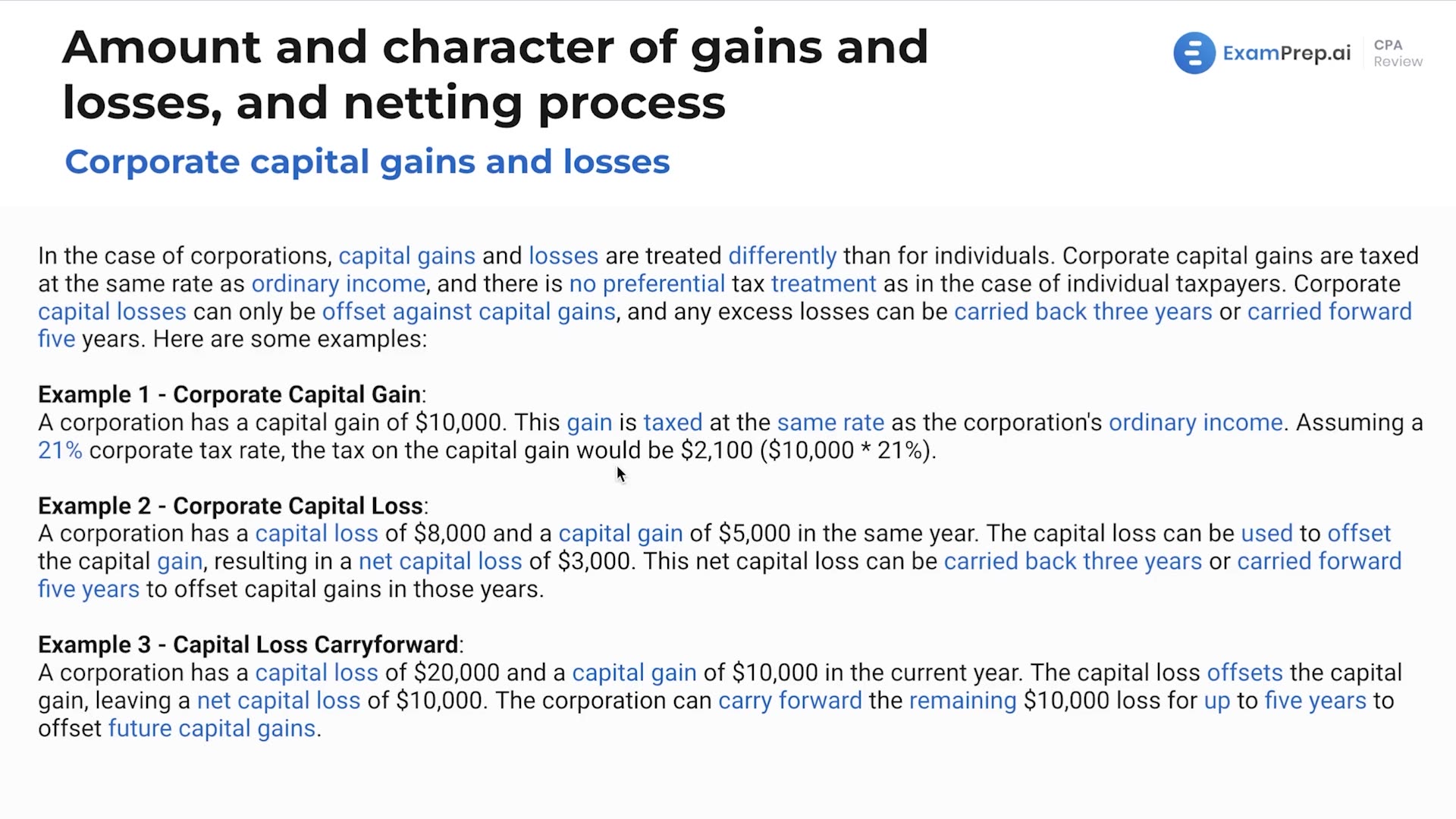

In this lesson, Nick Palazzolo, CPA, introduces the treatment of capital gains and losses for corporations, contrasting it with the handling for individual taxpayers. He clarifies that corporate capital gains do not benefit from a preferential tax rate and are taxed like ordinary income. Nick also explains that corporate capital losses are only allowed to be offset against capital gains, detailing the carryback and carryforward rules with practical examples. By outlining a clear comparison, he simplifies the complex topic of capital gains and losses and prepares for a deeper dive into corporate taxation in upcoming lessons.

This video and the rest on this topic are available with any paid plan.

See Pricing