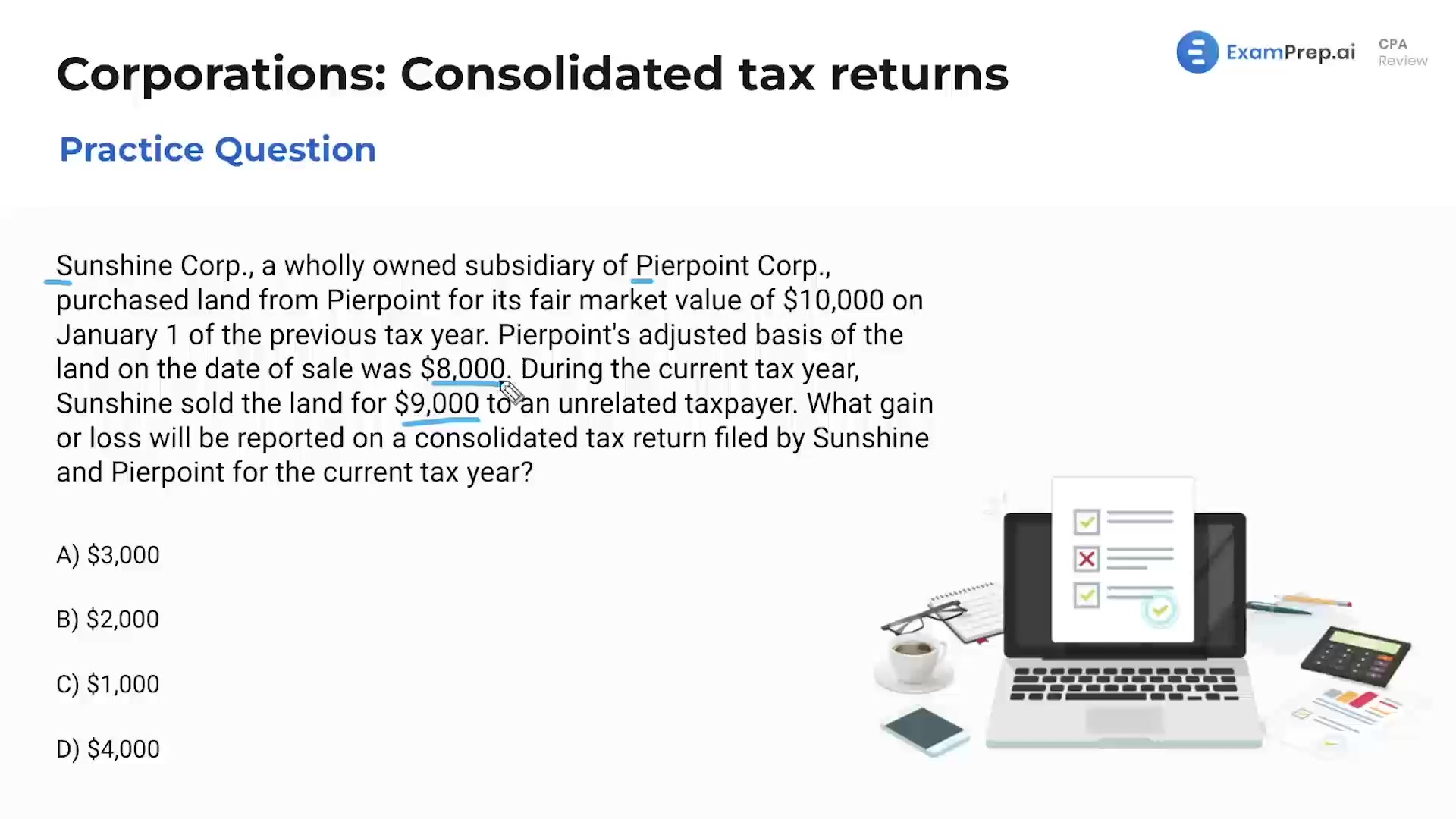

In this lesson, Nick Palazzolo, CPA, dives into the nitty-gritty of consolidated tax returns, starting with a complex multiple-choice question that deals with the recognition of gain or loss on a consolidated return when involving parent-subsidiary transactions. He breaks down the nuances of basis adjustments in related party transactions, highlighting the implications for tax recognition when assets are sold to unrelated taxpayers. Nick then walks through a series of statements about elections to file consolidated tax returns, debunking common misconceptions and providing a clear-cut explanation of intercompany gains elimination and liability sharing among group members. Engaging with common exam question pitfalls, Nick ensures that the intricacies of consolidated tax filings are made clear, leaving no stone unturned in preparing for these types of questions.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free