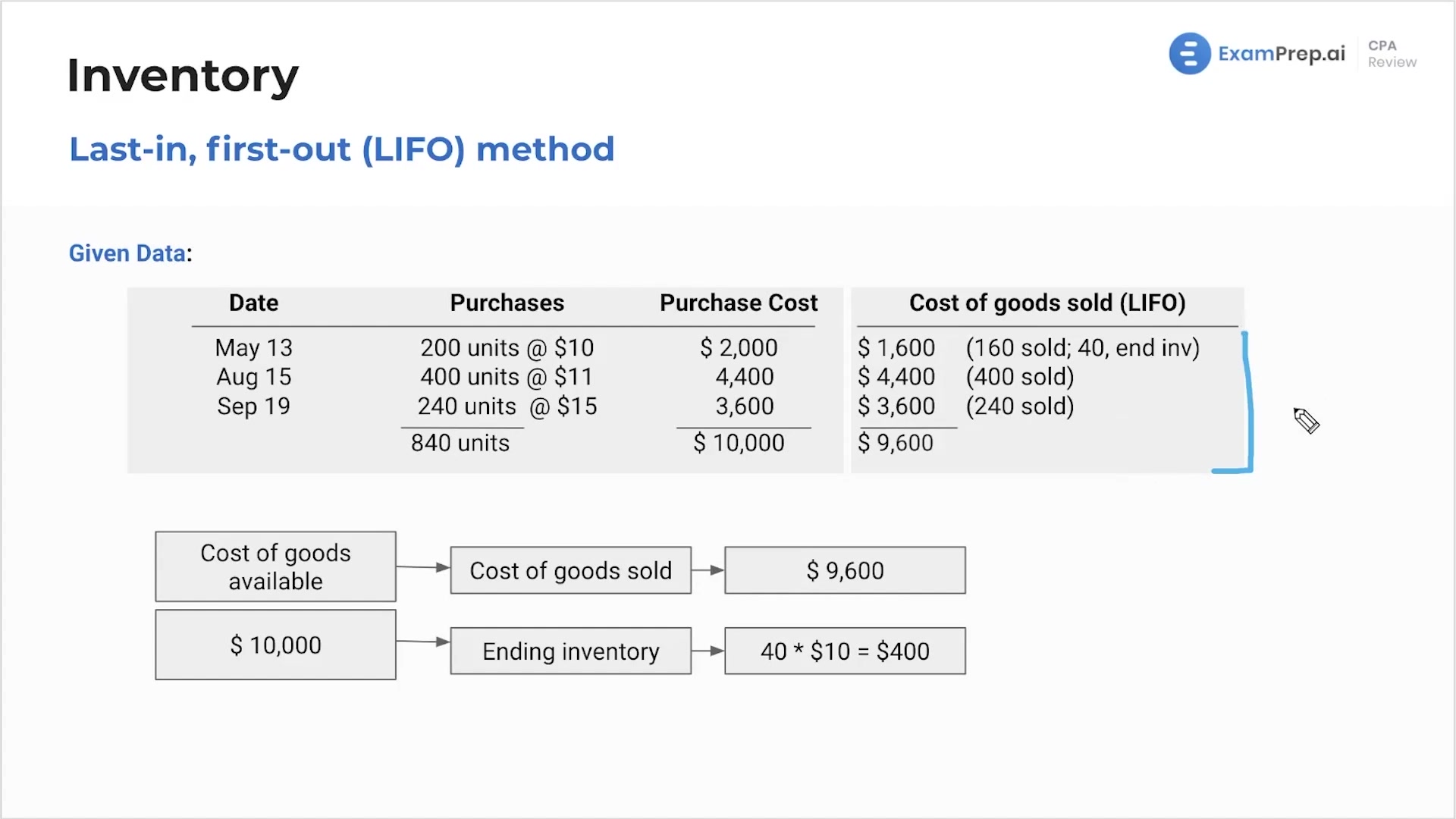

In this lesson, Nick Palazzolo, CPA, dives into practical examples of cost flow methods, specifically focusing on weighted average and LIFO (Last-In, First-Out) calculations. By dissecting actual scenarios that may arise in practice, he clarifies how to determine the cost of goods sold and ending inventory balances under each method. Nick starts with a straightforward explanation of per unit cost calculation for the weighted average method, recommending that rounding should be saved for the final step to maintain precision throughout the process. Then, he transitions to LIFO under a periodic system, showing how to compute inventory costs using the last purchases first. Nick wraps up by highlighting the contrasts between different cost flow assumptions and their impacts on financial reporting, especially in periods of changing prices. Throughout the lesson, strategic tips are given to handle common test questions and improve efficiency in calculations.

This video and the rest on this topic are available with any paid plan.

See Pricing