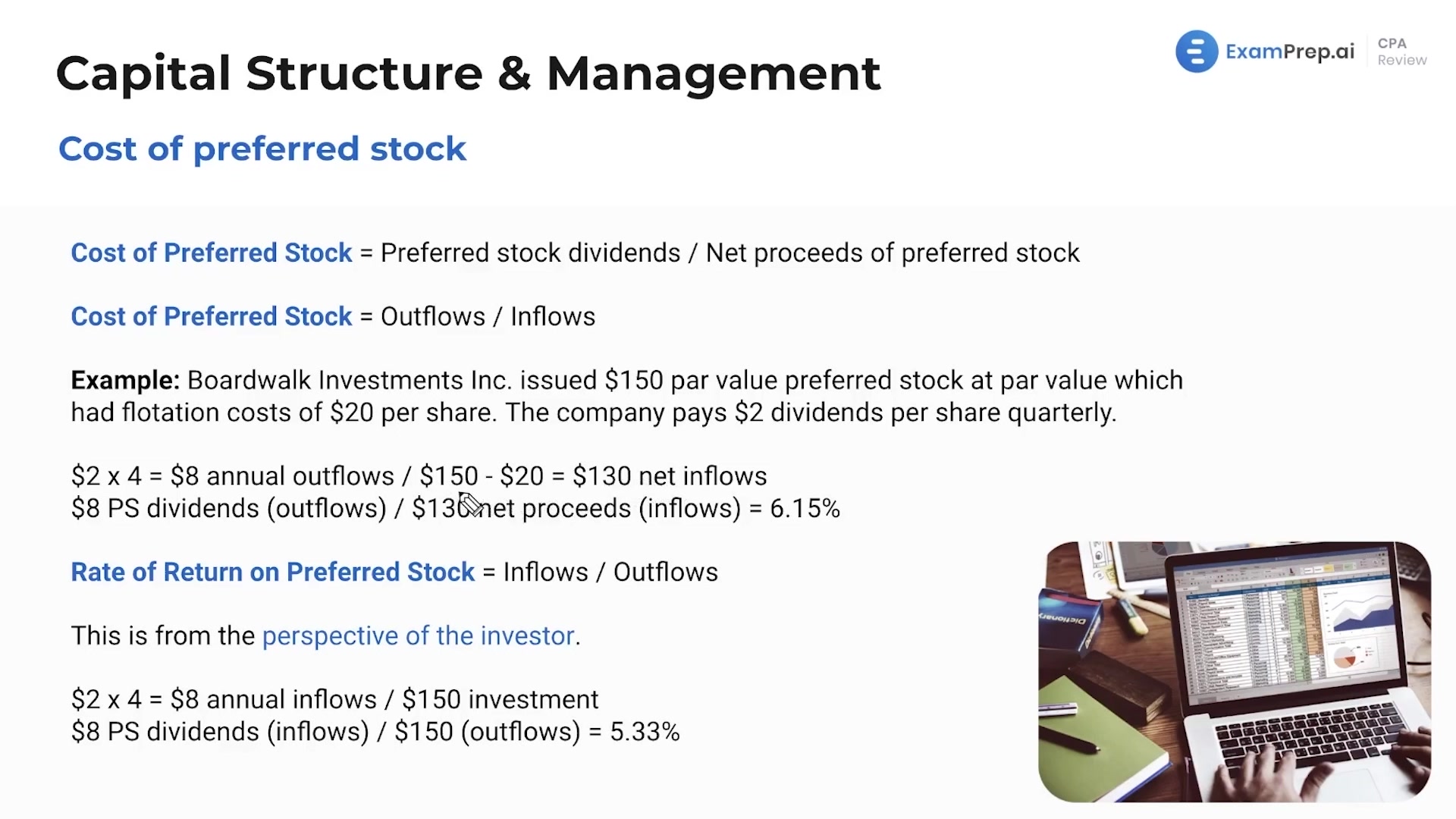

In this lesson, Nick Palazzolo, CPA, breaks down the essentials of calculating the cost of preferred stock—a topic he believes is critical for thorough exam preparation. He illustrates how to determine both the company's cost of issuing preferred stock and the investor’s rate of return using practical examples, including par value, flotation costs, and quarterly dividends. Nick simplifies the process by walking through a step-by-step computation, clarifying that the cost to the company and the investor's return can differ due to fees. The lesson emphasizes the importance of the timing of periodic payments and ends with a note on the tax treatment of preferred stock dividends, distinguishing them from debt but pointing out their non-deductibility for tax purposes.

This video and the rest on this topic are available with any paid plan.

See Pricing