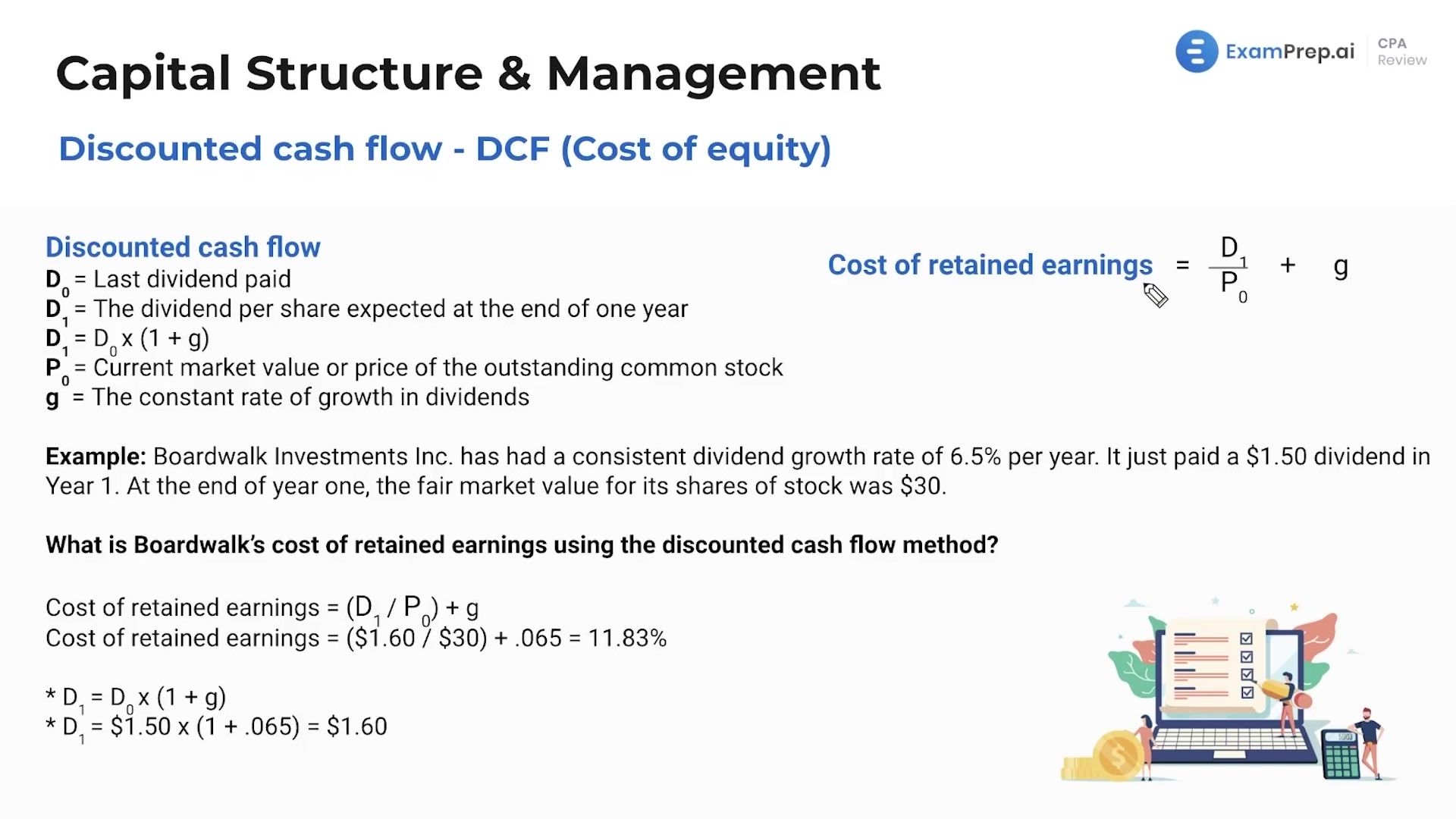

In this lesson, Nick Palazzolo, CPA, unravels the complexities of computing the cost of retained earnings, also known as the cost of equity, which is essential for corporate valuation and financial planning. He breaks down the capital asset pricing model (CAPM), the go-to method for determining the cost of equity, and elucidates its key components: the risk-free rate, market risk premium, and the beta coefficient. Using clear examples, Nick demonstrates how to calculate the cost of retained earnings using the CAPM formula, ensuring a comprehensive understanding of how each element—such as time value of money, dividend payouts, and stock volatility—affects the final figure. With this lesson, grasp the pragmatic application of the CAPM in real-world valuations and the importance of its results in the strategic decision-making process.

This video and the rest on this topic are available with any paid plan.

See Pricing