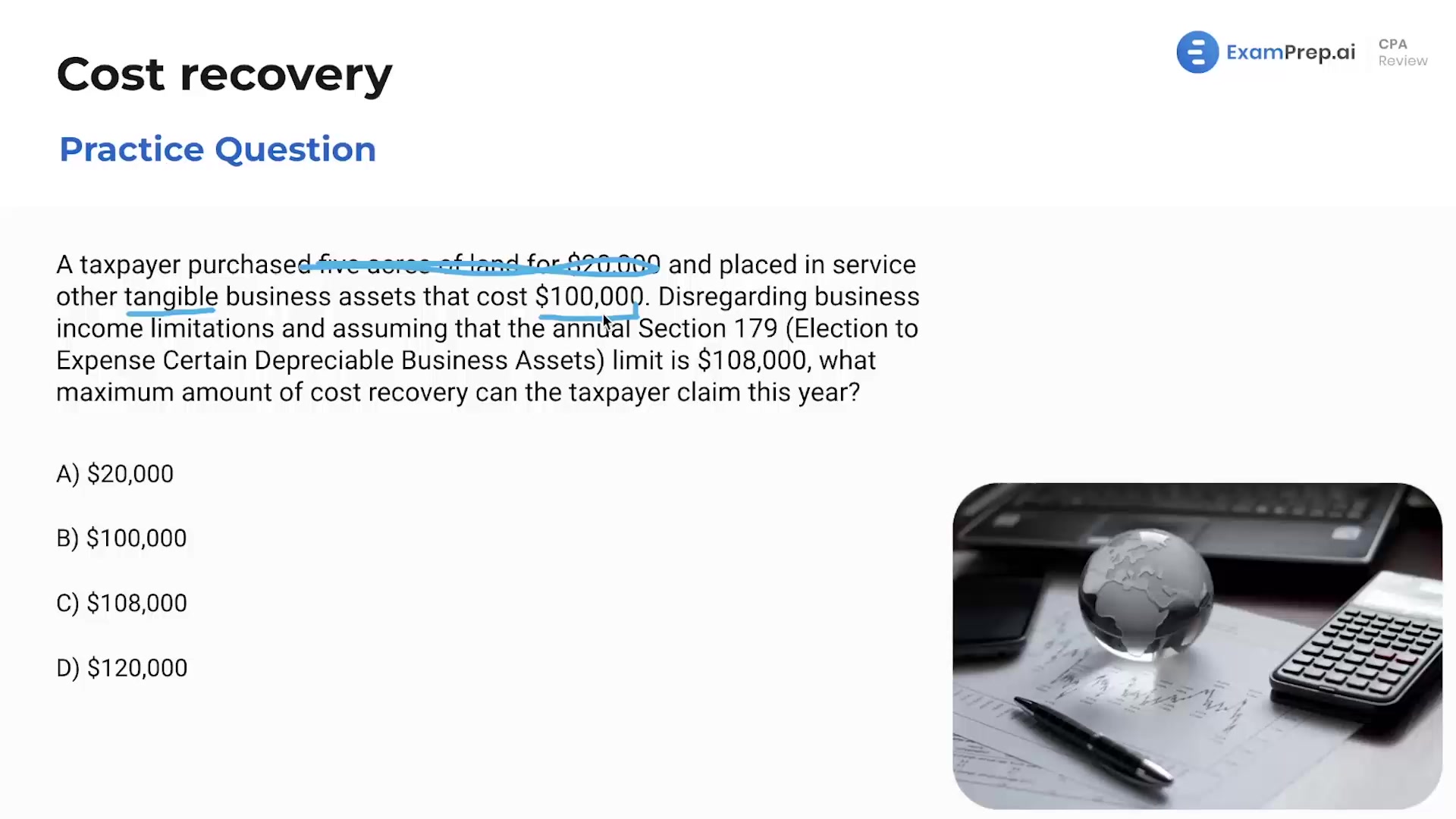

In this lesson, Nick Palazzolo, CPA, tackles practice questions on cost recovery, providing in-depth explanations on how to determine the maximum deductible amount under Section 179. He skillfully navigates through potential pitfalls by clarifying the distinction between depreciable and non-depreciable assets, such as land, and explains the relevance of tangible business assets in the deduction process. Furthermore, Nick delves into the specifics of intangible asset amortization, particularly highlighting a covenant not to compete, and stresses the importance of recognizing the fixed 15-year amortization period regardless of contract complexities. Throughout the lesson, Nick empowers everyone with tips and strategies to confidently approach multiple choice questions and emphasizes the importance of understanding these key tax concepts.

This video and the rest on this topic are available with any paid plan.

See Pricing