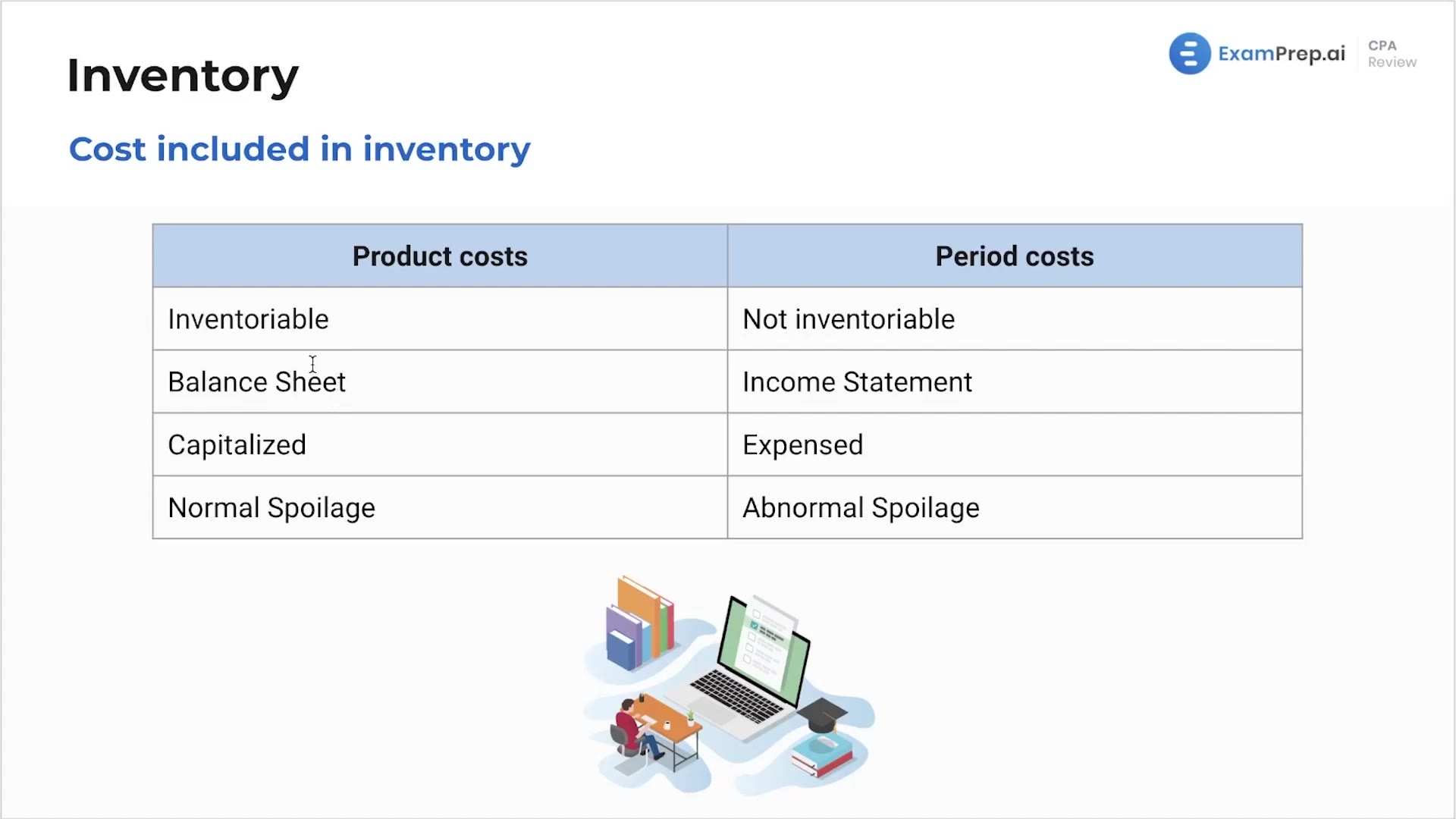

In this lesson, Nick Palazzolo, CPA, clarifies the distinctions between product costs and period costs and their impact on financial statements. Taking a closer look at the process of capitalizing versus expensing, Nick highlights the key differences in handling costs according to GAAP and FASB rules. He uses relatable examples, like normal spoilage during production, to demonstrate how certain costs are treated as inventorable assets and therefore capitalized in the balance sheet. Additionally, the lesson covers period costs, such as abnormal spoilage, and discusses why expensing and reporting these on the income statement may be favorable for a company's financial health. Keep an eye out for these concepts crossing over from the BEC to the FAR sections.

This video and the rest on this topic are available with any paid plan.

See Pricing