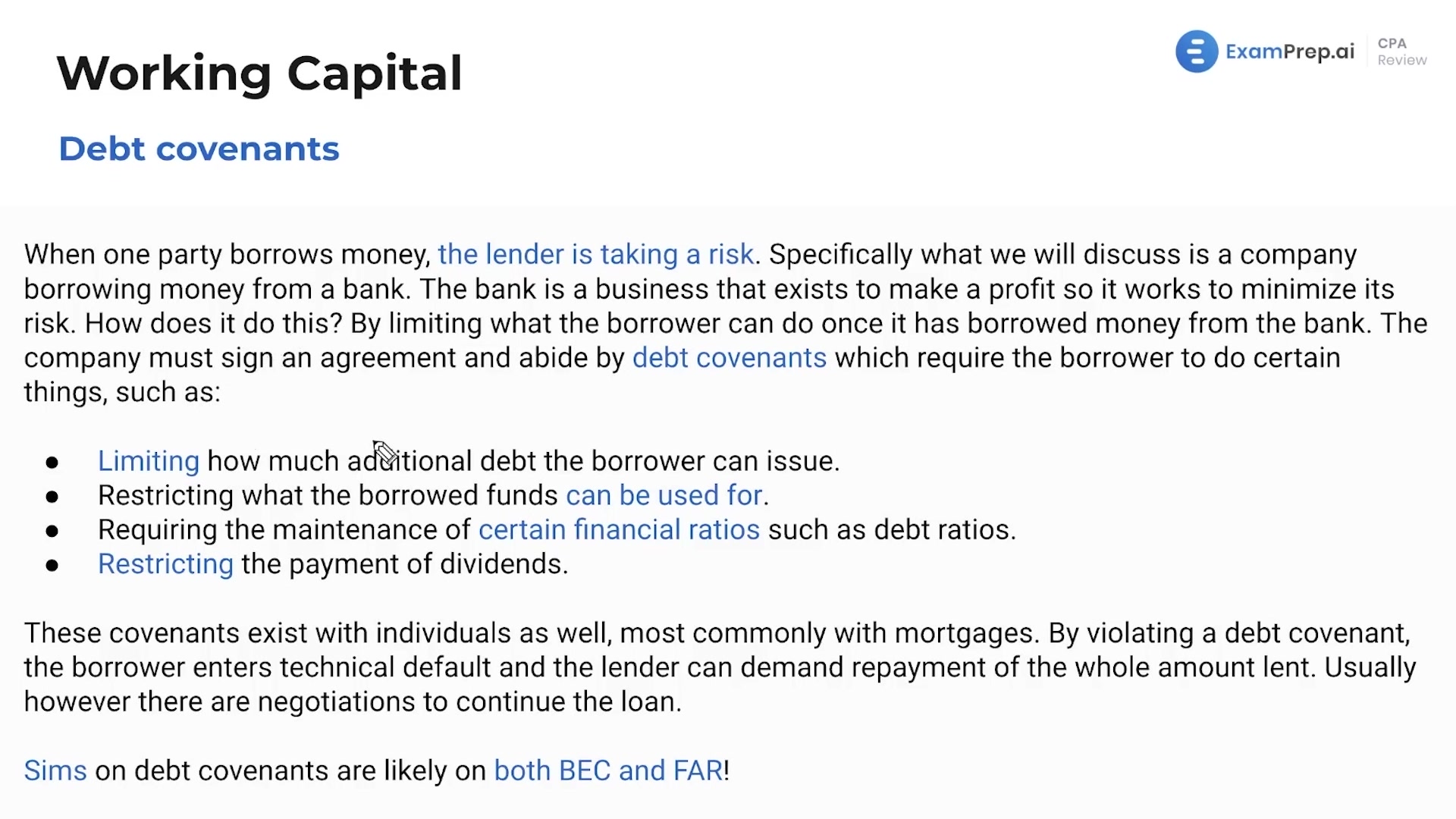

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of debt covenants, a crucial aspect for borrowers and lenders alike. He simplifies the concept by comparing it to real-life scenarios, such as taking out a mortgage, and clarifies that these covenants act as the lender’s tool to mitigate risk. Nick dives into the various restrictions that debt covenants can impose on borrowers, such as limitations on additional debt issuance and restrictions on how borrowed funds can be used. He also highlights the severe consequences of covenant violations, including steep fees and the potential for immediate loan repayment demands. The discussion covers the importance of maintaining certain financial ratios and how violating covenants puts the borrower in technical default, often leading to negotiations rather than immediate repercussions. The engaging explanation extends a knowing nod to the relevance of debt covenants in multiple CPA exam sections, ensuring that the focus is sharp and the Netflix queues are forgotten, at least for the duration of the lesson.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free