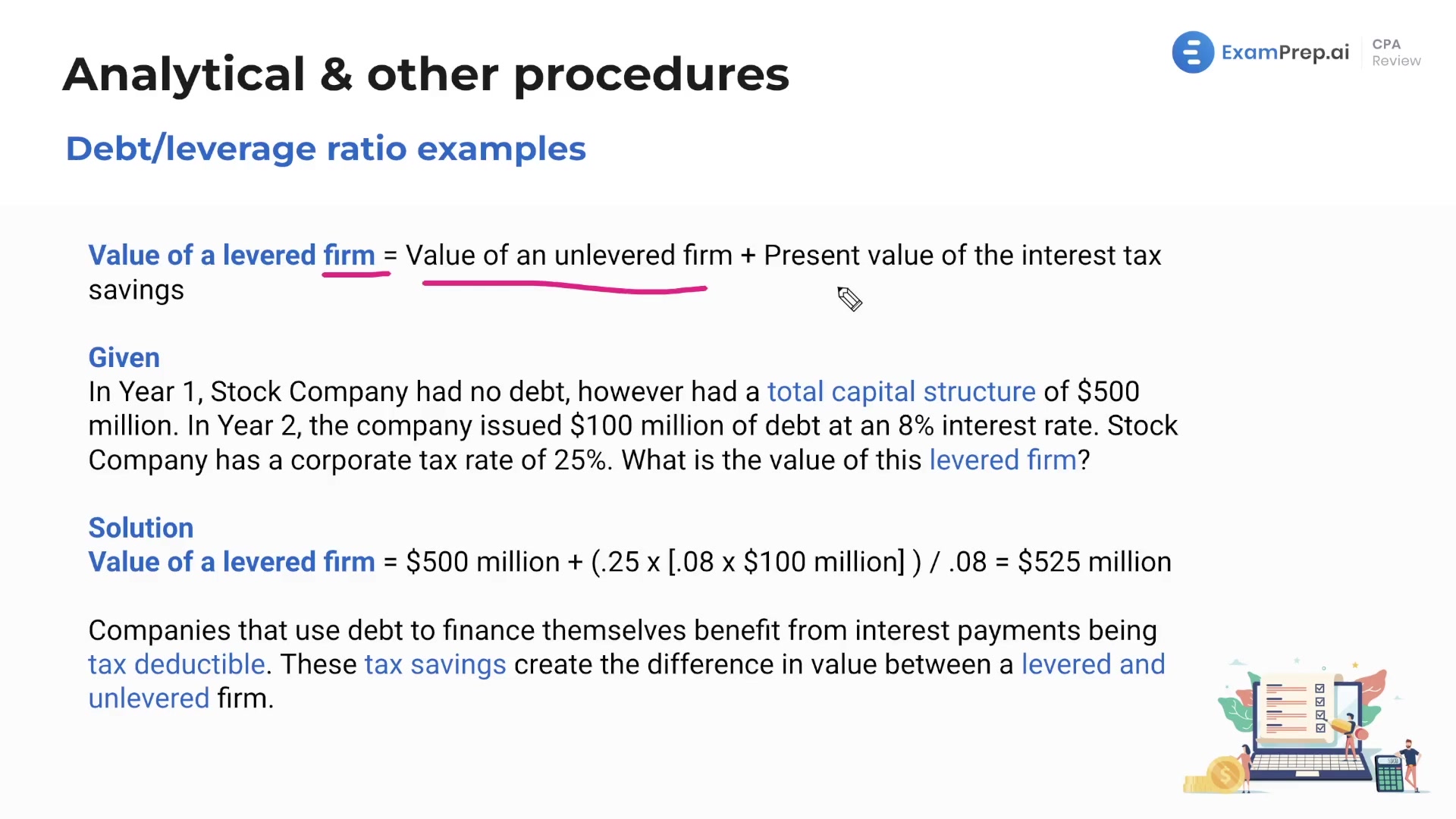

This lesson covers various debt or leverage ratios, focusing on the total debt ratio, debt to equity ratio, and times interest earned ratio. The importance of times interest earned ratio, which indicates a company's ability to cover its interest expenses, is explained in detail. The lesson also explores the concept of a levered firm and how the value of a levered firm is determined. Real-life examples are provided to illustrate how to calculate the value of a levered firm, taking into account the present value of interest tax savings. The analysis offers insight into the difference in value between a levered and unlevered firm and how companies benefit from interest expenses being tax-deductible.

This video and the rest on this topic are available with any paid plan.

See Pricing