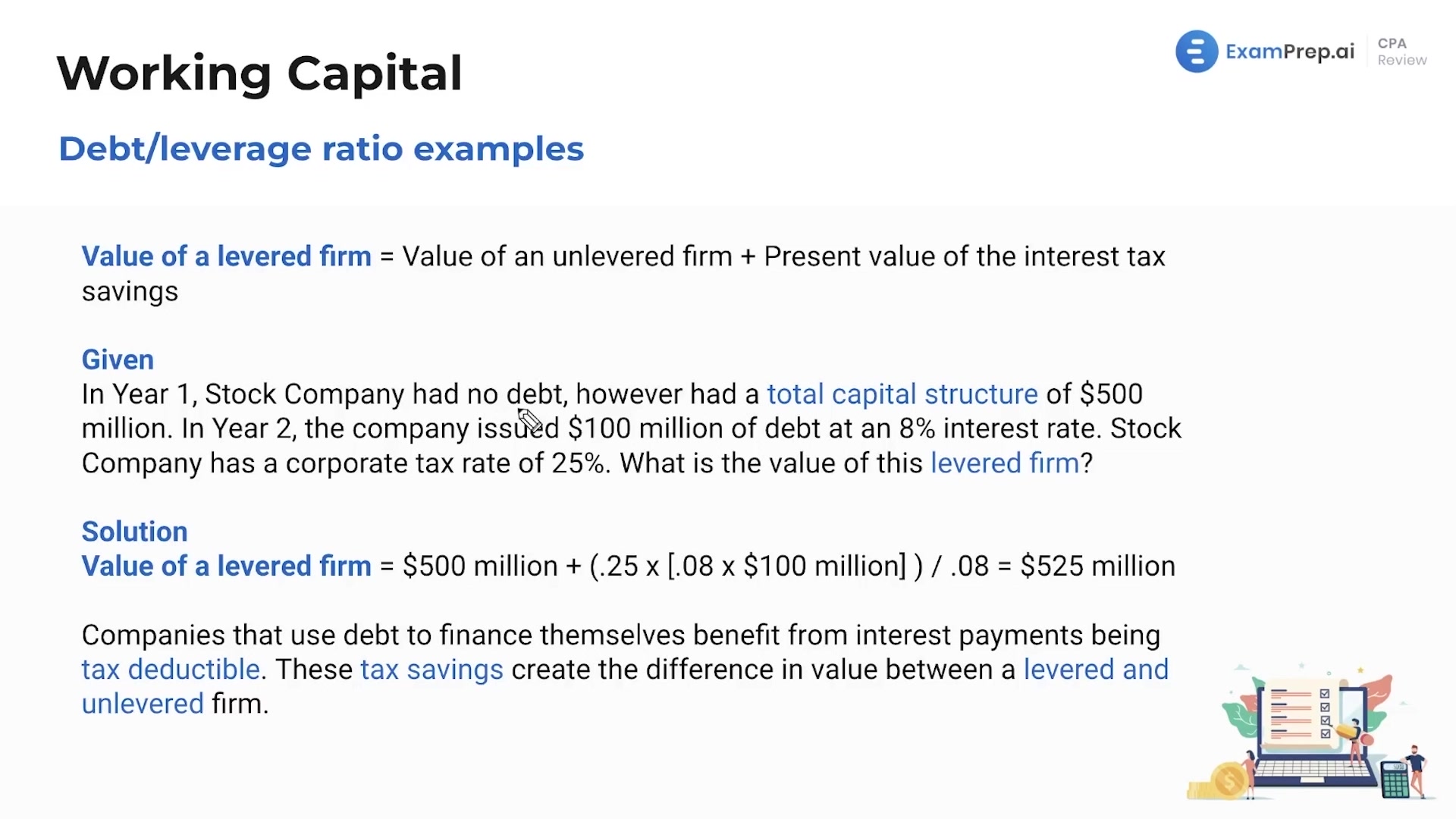

In this lesson, Nick Palazzolo, CPA, breaks down various debt and leverage ratios essential for evaluating a company's financial health and stability. Grasping how a business maintains and handles its debt is crucial for both management and potential investors, and equally important for banks when deciding on creditworthiness. Nick demystifies concepts like the value of a levered firm and provides easy-to-understand explanations of key formulas, such as total debt ratio (debt divided by assets) and debt-to-equity ratio (debt divided by equity). He underscores the significance of the times interest earned ratio, a key indicator of how well a company is doing in terms of its earnings relative to its interest obligations. The lesson is rounded off with a practical example showcasing how to calculate the value of a leveraged firm, emphasizing the added complexity and benefit of tax savings from interest payments.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free