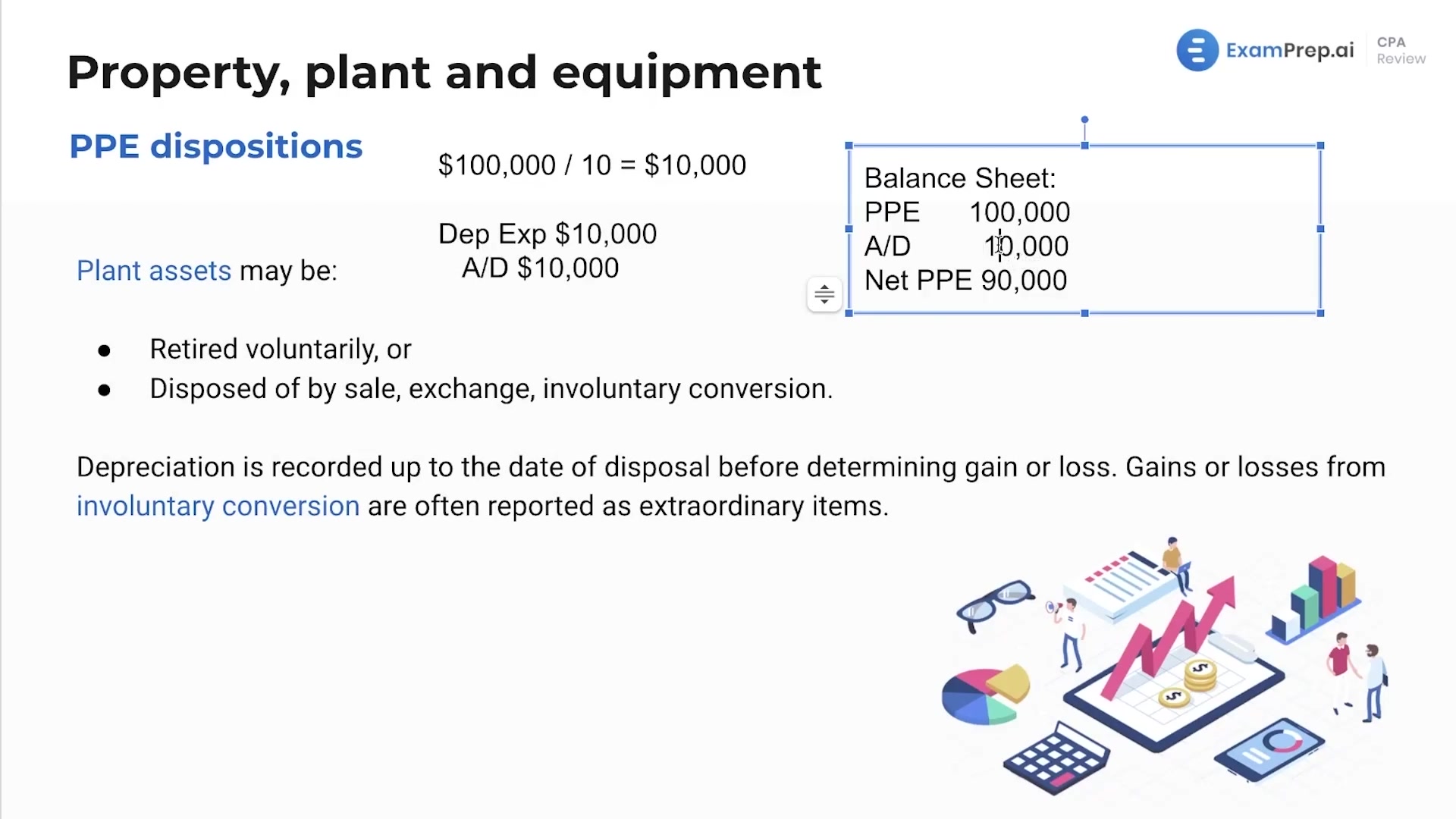

In this lesson, Nick Palazzolo, CPA, unfolds the process of property, plant, and equipment (PP&E) disposal, explaining what happens when these tangible long-term assets reach the end of their useful life or need to be discarded prematurely. Whether it's through a sale or simply tossing it out, Nick clearly delineates how to record depreciation up until the point of disposal to determine any gains or losses. With his easy-to-follow illustration, he walks through journal entries using clear examples to show how to handle the original value and accumulated depreciation of an asset. Through a practical scenario of selling a piece of equipment, Nick demonstrates the entry for cash received, disposal of the asset, the reversal of its accumulated depreciation, and how to reflect a gain in the financial statements, ensuring everything is wrapped up with a neat understanding of the balance sheet's new look post-disposal.

This video and the rest on this topic are available with any paid plan.

See Pricing