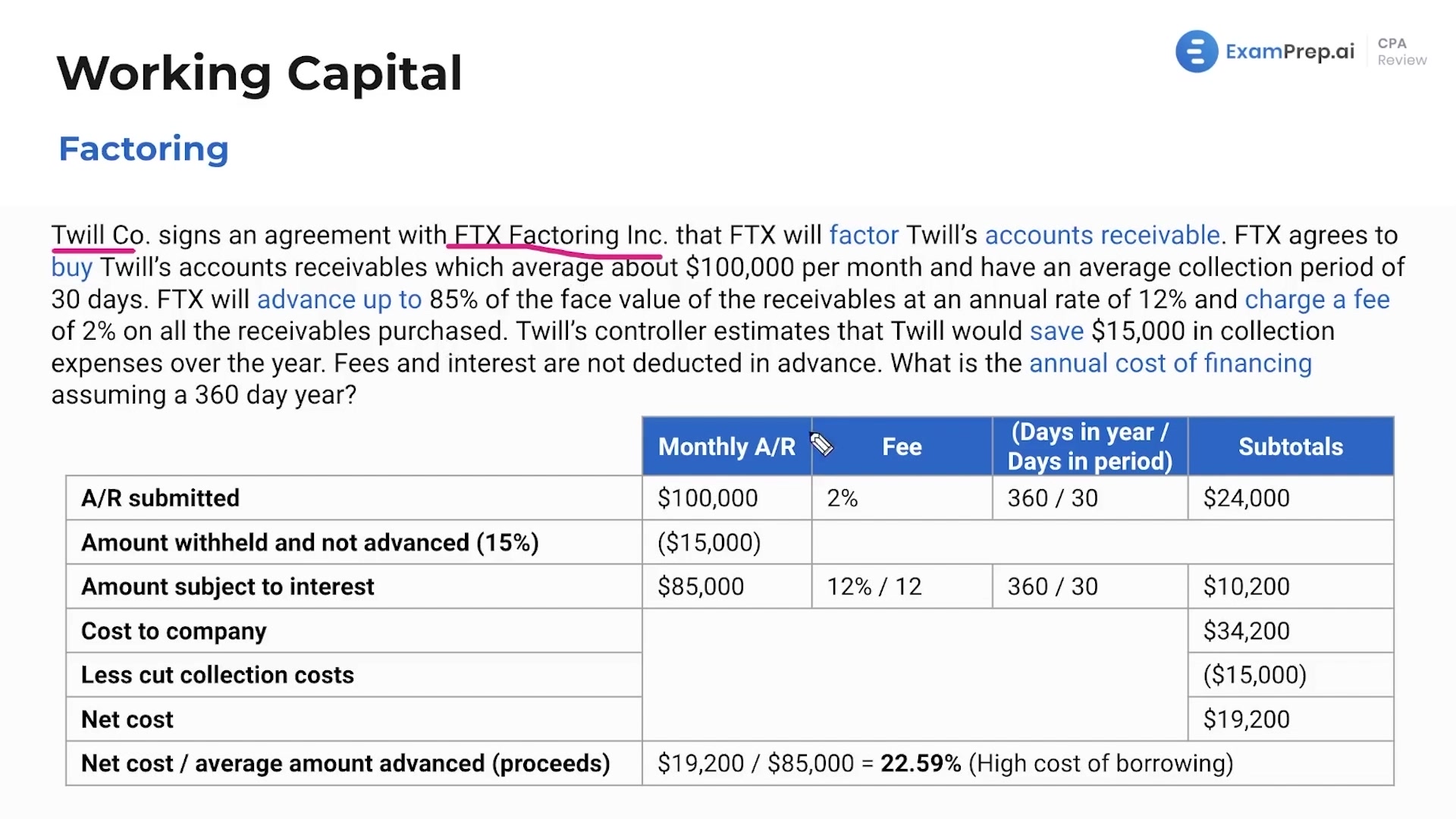

In this lesson, explore various strategies for managing accounts receivable when direct collection isn't possible. Nick Palazzolo, CPA, breaks down the concepts of secured borrowing and the sale of receivables, helping to understand how businesses can efficiently manage their working capital by either using receivables as collateral to secure a low-interest loan or by selling them to a third party. He walks through the benefits and risks associated with each method, from maintaining ownership and control in secured borrowing to transferring the risks and rewards through the sale of receivables to a factor. The dynamics of these transactions are dissected to ensure a thorough grasp of how they can be used to manage short-term assets and liabilities, making it a vital toolbox for maintaining the financial health of a business. In addition, Nick demonstrates the concepts with a practical example that brings the financial mathematics of these operations to life, highlighting the cost-benefit considerations that companies must evaluate.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free